By Antonio Rocha, El Deber:

Given the situation in the current year’s first quarter, with higher year-on-year inflation accumulated by March, the persistent decline in national exports, reduced imports due to the absence of competitive currency and payment methods, coupled with shortages of fuel and inputs for industry and agriculture, I believe we must fasten our seat belts and use oxygen masks in anticipation of greater turbulence and a possible forced landing.

It makes no sense to continue denying reality and claiming that everything is fine when we cannot import, when we have to buy dollars at a 20% premium over the official exchange rate, when we lose 30% of the production of the main national crop due to the absence of biotechnology, when there is not enough diesel to harvest the summer crops, or when we cannot fully utilize the waterway due to lack of cleaning and dredging in the access channel. We are not fine!

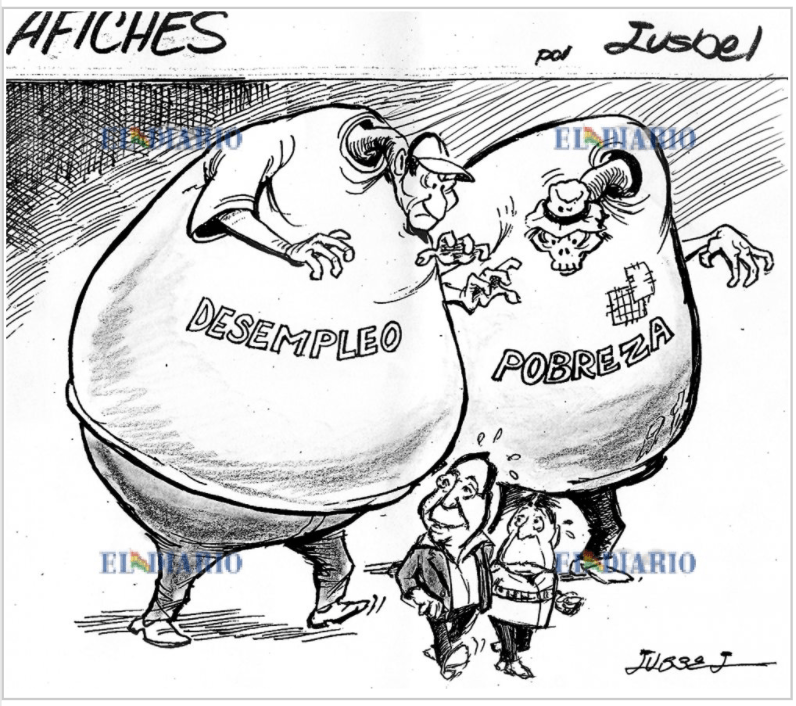

In addition to the structural problems of economic policy resulting from the current model’s implementation, such as the swollen fiscal deficit, the bloating of the public sector and state-owned enterprises, unsustainable and opaque subsidy policies, and public investments without tenders in companies with uncertain returns. Beyond these afflictions affecting the economy, we must realize that we are all in the same boat; therefore, either we all reach a safe harbor or we all flounder, so we must row together in concert.

Let’s look at the external context and forecasts. In its latest report on the World Economic Outlook, the International Monetary Fund (IMF) warns of a slowdown in global economy to just over 3%, marking a negative trend in the growth rate until 2029. The main reason is the absence of resilient structural adjustment measures that take into account emerging technologies such as Artificial Intelligence and Knowledge-based Exports, particularly in middle and low-income economies, which will further widen the growth gap with more developed countries.

Meanwhile, the World Bank’s latest review of its regional reports on Latin America and the Caribbean economies predicts that GDP growth in the Region will close at 2% for 2023 and is expected to reach 2.3% in 2024. The Bank’s outlook for Bolivia is not encouraging, due to problems of public deficit, reduction of reserves, and level of indebtedness, with a confirmation of a 2.4% GDP increase in 2023 and a prospect of reduction to 1.4% for 2024. This economic contraction is already observed in sectors such as agriculture, hydrocarbons, and services in the first quarter of this year.

Regarding global trade forecasts, the WTO reported that “global trade in goods is expected to gradually rebound this year following a contraction in 2023 driven by persistent effects of high energy prices and inflation. World merchandise trade volume should increase by 2.6% in 2024 and 3.3% in 2025 after falling by 1.2% in 2023. However, regional conflicts, geopolitical tensions, and uncertainty in economic policy pose significant downside risks to the forecast.” In Bolivia’s case, the official report from the INE for the first month of the year already shows a 28% reduction in exports and a 10% reduction in imports.

Now, what are the adjustment measures that need to be concerted to avoid further deterioration of the economy and undesirable higher devaluation and inflation? The first and most urgent measures should be aimed at resolving or mitigating the financial and currency crisis. The more than $50 million obtained from BCB bonds should be reinjected into the financial system; relief credit should be sought from the IMF for balance of payments to inject at least $1.2 billion into the financial system; the legal reserve requirement in dollars should be reduced, the Financial Transaction Tax (ITF) should be eliminated, and the free exchange market should be decriminalized.

In terms of external trade policy, exports from all sectors should be completely liberalized while simultaneously freeing imports of inputs and raw materials for industry, including imports of soybeans, corn, and wheat to cover the grain milling deficit in the agro-industrial sector. If the export of raw materials is liberalized, it is only fair to liberalize their importation, ensuring equitable conditions.

Finally, along with freeing the use of biotechnology in agricultural production, the policy of incentivizing the importation of capital goods should be maintained, and greater public investment should be directed towards logistical infrastructure and trade facilitation, instead of continuing to purchase state-owned plants to accommodate politicians.

Por Antonio Rocha, El Deber:

Vista la situación al primer trimestre del año en curso, con mayor inflación anual acumulada a marzo, la persistente caída de las exportaciones nacionales, la reducción de las importaciones por la ausencia de divisas y medios de pago competitivos, a lo que se suma la escasez de combustibles e insumos destinados a la industria y la agropecuaria, creo que debemos ajustarnos los cinturones de seguridad y usar las mascarillas de oxígeno ante la previsión de mayor turbulencia y un eventual aterrizaje forzoso.

No tiene ningún sentido continuar con el negacionismo de la realidad y decir que estamos bien cuando no podemos importar, cuando debemos comprar dólares 20% por encima del tipo de cambio oficial, cuando se pierde 30% de la producción del principal cultivo nacional por ausencia de biotecnología, cuando no se tiene la cantidad suficiente de diésel para levantar la cosecha de verano o cuando no es posible usar a plenitud la Hidrovía por falta de limpieza y dragado en el canal de acceso. No estamos bien!

Además de los problemas estructurales de política económica resultantes de la aplicación del modelo vigente, tales como el abultado déficit fiscal, la elefantiasis del sector público y las empresas estatales, política de subsidio insostenible y poco transparente, inversiones públicas sin licitaciones en empresas con retorno incierto. Más allá de estos males que aquejan a la economía, habrá que tomar conciencia que todos navegamos en el mismo barco, por tanto, o todos llegamos a buen puerto, o todos naufragamos, por lo que nos tocará remar de manera concertada.

Veamos el contexto externo y las previsiones. En su último informe sobre las Perspectivas de la Economía Mundial, el Fondo Monetario Internacional (FMI) advierte sobre una ralentización de la economía global a poco más del 3%, marcando una tendencia negativa de la tasa de crecimiento hasta 2029. La razón principal es la ausencia medidas de ajuste estructural resilentes que tomen en cuenta nuevas tecnologías emergentes como la Inteligencia Artificial y las Exportaciones basadas en el Conocimiento, particularmente en las economías de ingresos medios y bajos, lo que a su vez profundizará la brecha del crecimiento con los países más desarrollados.

Por su parte el Banco Mundial en la última revisión de sus informes regionales sobre las economías de América Latina y El Caribe prevé que el crecimiento del producto interno bruto en la Región cerrará con 2% para el pasado 2023 y se espera para 2024 una tasa de crecimiento del 2,3%. Las perspectivas del Banco para Bolivia no son alentadoras, en razón a los problemas de déficit público, reducción de las reservas y nivel de endeudamiento, se confirma un cierre del 2023 con un incremento del PIB al 2,4% y una perspectiva de reducción al 1,4% para el 2024. Esta contracción de la economía ya se observa en los sectores, agropecuario, hidrocarburos y servicios, al primer trimestre del presente año.

Respecto a las previsiones del comercio mundial la OMC reportó que “se espera que el comercio mundial de bienes repunte gradualmente este año tras una contracción en 2023 impulsada por los efectos persistentes de los altos precios de la energía y la inflación. El volumen del comercio mundial de mercancías debería aumentar un 2,6% en 2024 y un 3,3% en 2025 después de caer un 1,2% en 2023. Sin embargo, los conflictos regionales, las tensiones geopolíticas y la incertidumbre en materia de política económica plantean importantes riesgos a la baja para el pronóstico”. En el caso de Bolivia el reporte oficial del INE al primer mes de año, ya da cuenta de una reducción de las exportaciones del 28% y las importaciones en 10%.

Ahora bien, cuales son las medidas de ajuste que se requieren concertar para evitar un mayor deterioro de la economía y una indeseada mayor devaluación e inflación. Las primeras medidas y más urgentes deben estar orientadas a resolver o mitigar la crisis financiera y cambiaria. Se deben reinyectar al sistema financiero los más de 50 millones de dólares ya obtenidos de los bonos del BCB; se debería gestionar un crédito de alivio a la balanza de pagos del FMI para inyectar por lo menos unos 1.200 millones al sistema financiero; se debe reducir el encaje legal en dólares y eliminar el ITF, junto con despenalizar el mercado cambiario libre.

En materia de política comercial externa se debería liberar por completo las exportaciones de todos los sectores y al mismo tiempo liberar las importaciones de insumos y materias primas destinadas a la industria, incluyendo las importaciones de grano de soya, maíz y trigo para cubrir el déficit de molienda de grano del sector agroindustrial. Si se libera la exportación de materias primas, es justo liberar la importación de las mismas garantizando equidad de condiciones.

Finalmente, junto con liberar el uso de la biotecnología en la producción agrícola, se debe mantener la política de incentivo a la importación de bienes de capital y destinar mayor inversión pública a la infraestructura logística y la facilitación del comercio, en vez de seguir comprando plantas estatales para albergar políticos.