El Diario:

The Bolivian records devaluation and loss of purchasing power

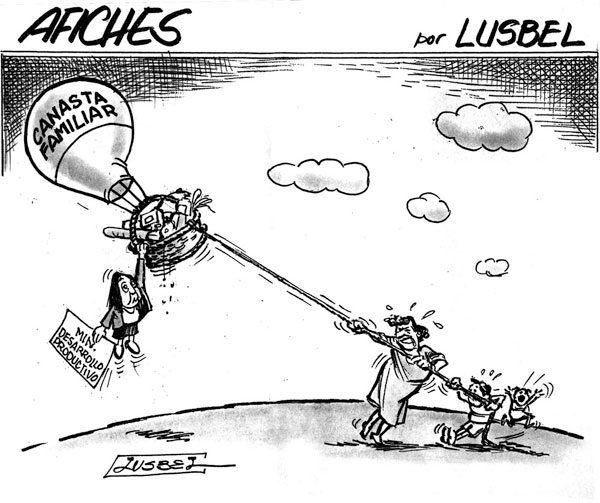

- Some companies communicated the increase in their prices to consumers, given the uncertain outlook for the supply of foreign currency.

The shortage of dollars in the Bolivian market causes an increase in the value of products and services, while the Government does not give signals of supplying the currency, so companies are already taking precautions and announcing price increases for their items; the food sector would be along the same line. The Bolivian currency has devalued and lost purchasing power, authorities have not yet responded to the needs of entrepreneurs and the productive sector.

Companies have already announced that, due to the shortage of dollars and the high commissions of banking entities for transfers abroad, they have announced an increase in their products.

Considering the complex financial situation due to the lack of dollars and the increase in commission for transfers abroad that rose to unsustainable percentages, we are directly affected by this situation, since all our products are imported, says a statement from Cristembo.

“Consequently, in addition to all the aforementioned, we find ourselves in the need to increase our prices starting from February 14, 2024, on all our products and all quotations made will be null and void and subject to the new prices,” the statement indicates.

Another company, Aiqar Bolivia, in its statement indicates that given the current situation with high costs of bank transfers and a shortage of foreign currencies for the payment of our imports, we are forced to make an adjustment of 25% in our prices from February 16.

“If you were thinking of buying an electric car due to the lack of fuels, they have already increased by 25%,” wrote Andrés Pucci, on his X (Twitter) @andrespucci account referring to the statement from Aiqar.

Likewise, the company Mainter proyectos, reports that given the current situation with high costs of bank transfers and a shortage of foreign currencies for the payment of our imports, we are obliged as of the date, February 16, to adjust our prices between 15% and 25%.

Rates

A few weeks ago, the Financial Supervision Authority (Asfi) published the commission rates, in the specific case of transfers abroad, when the consumer gives dollars to the entity or has an account in dollars, up to $1,000 is free, but if this amount is exceeded, 3% is charged, but in the case of transfers abroad when the consumer buys dollars from the entity – up to $1,000 is free – but if this amount is exceeded, the percentage will be determined by the entity.

In an interview with EL DIARIO, economist Darío Monasterio explained that the high percentage of commissions is due to the cost of acquiring the dollar, since at the official exchange rate the currency is scarce, so financial institutions must resort to the parallel market.

In this regard, the president of the College of Economists of Tarija, Fernando Romero, pointed out that the price of the official dollar is 6.96 bolivianos, but in the parallel, black or informal market, which operates in Bolivia, it is close to 9 bolivianos, and the national currency would have devalued by close to 30%.

While the loss of purchasing power ranges from 15 to 20%, considering these last months, in which the economy has been affected by social conflicts and the shortage of foreign currency, which has been going on since February of last year.

“It is difficult to quantify when there is no methodology or scientific study, since the Consumer Price Index (CPI) only measures price changes, and does not reflect the true level of inflation in our economy,” Romero said.

He suggests that a quarterly study should be conducted based on 1,000 bolivianos, to see if the same amount of products is purchased every so often with this amount.

The variation in prices in certain months of the year must be taken into account, such as Christmas and carnivals, in the face of changes in the market, especially in public demand.

“It is logical that purchasing power is lost not only for imported products due to dollar problems, but also for imported inflation itself,” he stressed, indicating that products from neighboring countries are expensive, such as Argentina, and Bolivia is a large consumer.

For his part, economist Gonzalo Chávez, in his social networks, maintains that the crisis is complex and there is no magic solution, it will take time to resolve.

He recommends that the Government recognize that there is a problem to take the necessary measures; he also points out that the Government’s economic model is in crisis; he clarifies that it is not a problem of flow, of liquidity, but rather a problem of solvency.

He referred to the commercial issue, for example, and said that more is purchased than is exported. Therefore, he proposes and agrees with the opinion of several economic analysts, that unnecessary expenses and the state apparatus must be reduced, as well as deficit state companies must be closed and the execution of new public industries must be stopped.

Likewise, Romero warns that if the Government does not make adjustments to its economic policy and corrects the imbalance in the country’s exchange and payment balance, this will generate a greater shortage of dollars. With 3 negative effects: Greater increase in the price of the American dollar in the black or parallel market; shortage or problems for the importation of various products (raw materials, inputs, others). For example, fuels, medicines, industrial inputs, among others; and an increase in prices in the economy (inflation), both of national production and imported, because as a result, there will be a loss of purchasing power of the income of Bolivians.

Dollar markets in the country

- THE OFFICIAL DOLLAR OF THE BCB, with an exchange rate of purchase (Bs 6.86) and sale (Bs 6.96) that has not changed since 2011, this is the least used due to its scarcity in the national financial system.

- THE FREE EXCHANGE DOLLAR, is one of the oldest, which although it offers the currency at the official exchange rate, its transactions are managed under the law of supply and demand, for now the sale is above Bs 8.

- THE BORDER DOLLAR, this is mainly used by those who carry out economic and commercial transactions at the country’s borders; it is quoted at the same level above Bs 8.

- THE WHOLESALE DOLLAR, which is offered by various individuals, families, or companies dedicated to the purchase and sale of dollars. Its price ranges from Bs 7.50 to 8.50 per unit. The selling price varies according to the quantity of dollars required, it is used by importers, for example.

- THE RETAIL DOLLAR, is the one that is sold in small quantities, mainly demanded by the average citizen, who requires it for saving, paying down payments, buying assets, or other purposes. (Source: Fernando Romero)

El boliviano registra devaluación y pérdida del valor adquisitivo

- Algunas empresas comunicaron la elevación de sus precios a los consumidores, ante el panorama incierto del abastecimiento de la divisa extranjera.

La escasez del dólar en el mercado boliviano provoca incremento del valor de productos y servicios, mientras el Gobierno no da señales de abastecer la divisa, por lo que las empresas ya toman sus recaudos y anuncian elevación de precios de sus artículos; el sector alimentario estaría por la misma línea. La moneda boliviana se devaluó y perdió poder adquisitivo, las autoridades todavía no dan respuesta a las necesidades de los empresarios y del sector productivo.

Las empresas ya comunicaron, que debido a la escasez del dólar y las altas comisiones de las entidades bancarias para transferencias en el exterior, anunciaron incremento de sus productos.

Considerando la compleja situación financiera debido a la falta de dólares y el incremento de la comisión por transferencias al exterior que subió a porcentajes insostenibles, nos vemos afectados directamente por esta situación, ya que todos nuestros productos son importados, señala un comunicado de Cristembo.

“En consecuencia, a todo lo antes mencionado, nos vemos en la necesidad de incrementar nuestros precios a partir del 14 de febrero de 2024 en todos nuestros productos y todas las cotizaciones realizadas quedarán sin efecto y sujetas a los precios nuevos”, indica el comunicado.

Otra empresa, Aiqar Bolivia, en su comunicado señala que ante la situación actual con altos costos de transferencias bancarias y escasez de divisas extranjeras para el pago de nuestras importaciones, nos vemos obligados a realizar un ajuste del 25% en nuestros precios a partir del 16 de febrero.

“Si pensaba comprar un auto eléctrico por la falta de combustibles, ya subieron 25%”, escribió Andrés Pucci, en su cuenta de X (Twitter) @andrespucci con referencia al comunicado de Aiqar.

También la empresa Mainter proyectos, comunica que ante la situación actual con altos costos de transferencias bancarias y escasez de divisas extranjeras para el pago de nuestras importaciones nos vemos obligados a partir de la fecha, 16 de febrero, a ajustar nuestros precios entre un 15% y 25%.

Tarifas

Hace unas semanas, la Autoridad de Supervisión del Sistema Financiero (Asfi) publicó las tarifas de las comisiones, en el caso específico de las transferencias al exterior, cuando el consumidor entrega dólares a la entidad o tiene una cuenta en dólares, hasta 1.000 dólares es gratuito, pero si pasa esta cifra se cobra 3%, pero en el caso de las transferencias al exterior cuando el consumidor compra dólares a la entidad –hasta 1.000 dólares es gratuito–, pero si excede este monto el porcentaje será determinado por la entidad.

En una entrevista con EL DIARIO, el economista Darío Monasterio, explicó que el alto porcentaje de las comisiones obedecían al costo que implica adquirir el dólar, pues al tipo de cambio oficial la divisa escasea, entonces deben acudir al paralelo las entidades financieras.

Al respecto, el presidente del Colegio de Economistas de Tarija, Fernando Romero, señaló que el precio del dólar oficial es de 6,96 bolivianos, pero en el paralelo, negro o informal, que se maneja en Bolivia, está cerca a los 9 bolivianos, y la moneda nacional se habría devaluado cerca al 30%.

Mientras que la pérdida del poder adquisitivo oscila entre 15 a 20%, considerando estos últimos meses, en que la economía ha sido afectada por conflictos sociales y por la escasez de la divisa extranjera, que viene desde febrero del año pasado.

“Es difícil cuantificar cuando no se tiene una metodología o estudio científico, ya que el Índice de Precios al Consumidor (IPC) sólo mide variación de precios, y no refleja el verdadero nivel de inflación de nuestra economía”, manifestó Romero.

Sugiere que se debe hacer un estudio trimestral con base a 1.000 bolivianos, para ver si se compra la misma cantidad de productos cada cierto tiempo con este monto.

Hay que tomar en cuenta la variación de los precios en determinados meses del año, como Navidad y carnavales, ante cambios en el mercado sobre todo en la demanda del público.

“Es lógico que se vaya perdiendo el poder adquisitivo no sólo de productos importados por problemas del dólar, sino por la misma inflación importada”, recalcó a tiempo de indicar que los productos de países vecinos son elevados, como el caso de Argentina, y Bolivia es un gran consumidor.

Por su parte, el economista Gonzalo Chávez, en sus redes sociales, sostiene que la crisis es compleja y no hay una solución mágica, tomará tiempo resolver.

Recomienda al Gobierno reconocer que hay un problema para tomar las medidas pertinentes; también señala que el modelo económico del Gobierno está en crisis; aclara que no es un problema de flujo, de liquidez, sino es un problema de solvencia.

Se refirió al tema comercial, por ejemplo, y dijo que se compra más de lo que se exporta. Por ello plantea y coincide con la opinión de varios analistas económicos, de que se debe reducir los gastos innecesarios y el aparato del Estado, así como cerrar empresas estatales deficitarias y parar la ejecución de nuevas industrias públicas.

Asimismo, Romero advierte que si es que el Gobierno no realiza reajustes en su política económica y corrige el desequilibrio en la balanza cambiaria y de pagos en el país, esto generará mayor escasez de dólares. Con 3 efectos negativos: Mayor encarecimiento del dólar americano en el mercado negro o paralelo; desabastecimiento o problemas para la importación de diversos productos (materias primas, insumos, otros). Por ejemplo, carburantes, medicamentos, insumos industriales, otros; y elevación de los precios en la economía (inflación), tanto de producción nacional como los importados, debido a que como resultado será la pérdida del poder adquisitivo del ingreso de los bolivianos.

Mercados del dólar en el país

1. El DÓLAR OFICIAL DEL BCB, con un tipo de cambio de compra (Bs 6,86) y venta (Bs 6,96) que no se modifica desde el 2011, este es el menos usado debido a su escasez en el sistema financiero nacional.

2. El DÓLAR LIBRE CAMBISTA, es uno de los más antiguos, que a pesar de que ofrecen la divisa al tipo de cambio oficial, sus transacciones se manejan bajo la ley de la oferta y demanda, por ahora la venta está por encima de los Bs 8.

3. El DÓLAR FRONTERIZO, este es usado sobre todo por quienes realizan transacciones económicas y comerciales en las fronteras del país; se cotiza igual por encima de los Bs 8.

4. El DÓLAR MAYORISTA, el cual es ofertado por diversas personas, familias u empresas que se dedican a la compra y venta de dólares. Su precio oscila entre los Bs 7,50 a 8,50 por unidad. El precio de venta varía de acuerdo con la cantidad de dólares requeridos, es usado por los importadores, por ejemplo.

5. El DÓLAR MINORISTA, es aquel que es vendido en pequeñas cantidades, demando sobre todo por el ciudadano de a pie, quien requiere para ahorrar, pagar anticréticos, comprar activos u otros fines. (Fuente: Fernando Romero)