Signs of concern in the Bolivian economy

German Huanca (*)

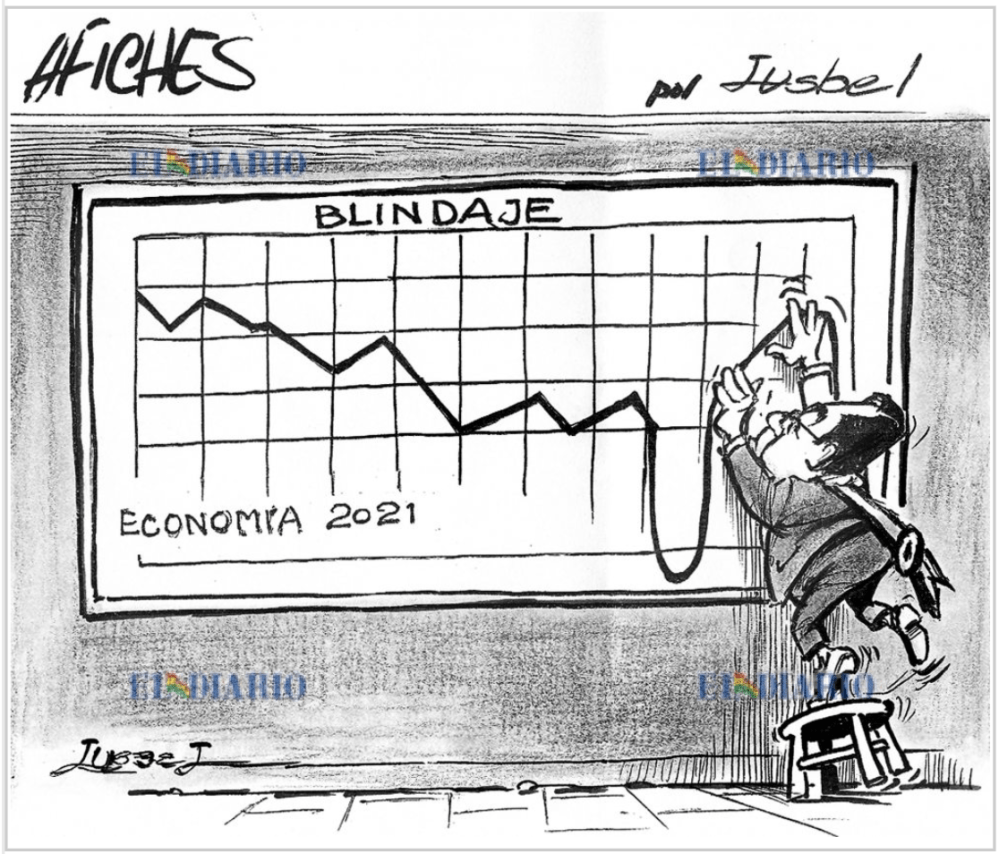

When finances begin to fail, the symptoms that manifest in a family economy, or a country, are evident. For example, income begins to fall, savings begin to be used and credits or loans increase. What is happening in the Bolivian economy is worrying, the signs are given. Now we are on the verge of a deficit in the balance of payments.

In 2010, the first sign of weakness of the “economic model” was observed when the MAS government attempted to eliminate the fuel subsidy, which is why it promulgated DS 748 on December 26 of that year in order to adjust fuel prices to market movements. The adjustment attempts were in vain, since the population did not accept and preferred that the subsidies continue. Currently, according to the General State Budget for 2023, the programmed subsidies are 8,079 million bolivianos equivalent to 1,160 million dollars, of which 1,097 million dollars correspond to the hydrocarbon subsidy and 63 million dollars to food.

In 2014, the Bolivian economy sent a second structural and visible signal, thus showing that economic sustainability was not guaranteed, this is seen in the fiscal deficit of 3.36%, a product of the fall in income from the sale of gas. to Brazil and Argentina. This indicator from that year until 2022 was negative. For its part, the government, instead of controlling public spending, preferred to finance the fiscal deficit with seigniorage. For the latter to be effective, it carried out a strong campaign to Bolivianize the financial system and in the face of each fiscal deficit in the following years, it increased the monetary issue to capture a part of its purchasing power.

In 2022, the international market sends us a third signal, Bolivia goes out in search of capital and it is found that sovereign bonds are no longer attractive to investors and instead of bringing in 2000 million dollars it only attracts 918 million dollars, curiously bought by the AFPs of Bolivia, thus affecting the resources of retirees without the population expressing itself about it. This time, these resources were necessary to fulfill the commitments made in 2012.

This same year, the fourth signal is given by the abrupt fall of International Reserves. Bolivia accumulated International Reserves up to 15,123 million dollars in 2014, but from that year on it was reduced at a rate of 1,415 million dollars per year, until reaching 3,796 million dollars in 2022. In order to recover the Reserves, the government promulgates Law 1503, intended to buy gold, and thus increase the BCB’s reserves; however, the BCB sold more gold (17tn) than it bought (0.068tn), that is, it reduced reserves instead of increasing them, to pay foreign debt commitments. This fourth sign becomes evident in the population with the shortage of dollars that begins to deal with a parallel (unofficial) exchange rate that reached up to 7.9 Bs for each dollar when the official one is 6.96.

Faced with the need for liquidity, the Bolivian government begins to get rid of more assets and sends a fifth signal about the economic situation, and it occurs through the sale of Special Drawing Rights (SDRs). According to a report from the International Monetary Fund -IMF- it is revealed that Bolivia changed its SDRs for dollars, going from possessing 394 million SDRs (equivalent to 538 million dollars) to only 39 million SDRs (equivalent to 53 million dollars), using thus 90% of the resources that Bolivia had in that organization. The need for liquidity to pay foreign debt commitments is becoming increasingly imminent.

Finally, although the shortage of dollars continues in the economy, the approach of a deficit in the balance of payments, which is the impossibility of paying all imports and external debt, is much greater pressure to force an adjustment in the exchange rate, this from a point of view of economic rationality. This analysis does not incorporate variables from the underground economy. The signals were given, the warnings from economists and analysts were mentioned; However, the MAS government prefers to maintain high public spending, maintain the fiscal deficit and sustain its “economic model” with superfluous and misleading state advertising.

(*) Economist

Señales que preocupan en la economía boliviana

German Huanca (*)

Cuando las finanzas empiezan a fallar, los síntomas que se manifiestan en una economía familiar, o de un país son evidentes. Por ejemplo, los ingresos empiezan a caer, se empiezan a usar los ahorros y se incrementan los créditos o préstamos. Lo que pasa en la economía boliviana es preocupante, las señales están dadas. Ahora estamos en puertas de un déficit en la balanza de pagos.

El año 2010, se observó la primera señal de debilidad del “modelo económico” cuando el gobierno del MAS tuvo un intento de eliminación de la subvención al combustible, por ello promulgó el 26 de diciembre de ese año el DS 748 con la finalidad de ajustar los precios del combustible a los movimientos del mercado. Vanos fueron los intentos del ajuste, ya que la población no aceptó y prefirió que las subvenciones continúen. Actualmente, de acuerdo con el Presupuesto General del Estado del 2023, las subvenciones programadas son 8.079 millones de bolivianos equivalentes a 1.160 millones de dólares, de los cuales 1.097 millones de dólares corresponde a la subvención de hidrocarburos y 63 millones de dólares a los alimentos.

El año 2014, la economía de Bolivia lanza una segunda señal estructural y visible, mostrando así de que la sostenibilidad económica no estaba garantizada, ésta se visualiza en el déficit fiscal de 3.36%, producto de la caída de los ingresos por la venta de gas a Brasil y Argentina. Este indicador desde ese año hasta el 2022 fue negativo. Por su parte, el gobierno en vez de controlar el gasto público prefirió financiar el déficit fiscal con el señoreaje. Para que éste último sea efectivo, realizó una campaña fuerte de bolivianización del sistema financiero y ante cada déficit fiscal de los años siguientes, fue aumentando la emisión monetaria para capturar una parte de su poder adquisitivo.

El año 2022, el mercado internacional nos envía una tercera señal, Bolivia sale a la busca de capitales y se encuentra que los bonos soberanos ya no son más atrayentes para los inversionistas y en lugar de traer 2000 millones de dólares solo atrae 918 millones de dólares, curiosamente comprados por las AFPs de Bolivia, afectando de esta manera los recursos de los jubilados sin que la población se manifieste al respecto. Esta vez, estos recursos eran necesarios para cumplir los compromisos asumidos el año 2012.

Este mismo año, la cuarta señal viene dada por la caída abrupta de las Reservas Internacionales. Bolivia acumuló Reservas Internacionales hasta 15.123 millones de dólares el 2014, pero a partir de ese año fue reduciendo a razón de 1.415 millones de dólares por año, hasta llegar a 3.796 Millones de dólares el 2022. A fin de recuperar las Reservas, el gobierno promulga la Ley 1503, destinada a comprar oro, y así aumentar las reservas del BCB; sin embargo, el BCB vendió más oro (17tn) que comprar (0.068 tn), o sea redujo las reservas en vez de aumentar, para pagar compromisos de deuda externa. Esta cuarta señal, se hace evidente en la población con la escasez de dólares que empieza a lidiar con un tipo de cambio paralelo (no oficial) que llegó hasta 7.9 Bs por cada dólar cuando el oficial es de 6.96.

Ante la necesidad de liquidez, el gobierno boliviano empieza a deshacerse de más activos y envía una quinta señal sobre la situación económica, y se da a través de la venta de Derechos Especiales de Giro (DEGs). según un reporte del Fondo Monetario Internacional -FMI- se devela que Bolivia cambió sus DEGs por dólares, pasando a poseer de 394 millones DEGs (equivalentes a 538 millones de dólares) a sólo 39 millones de DEGs (equivalentes 53 millones de dólares), usando así el 90% de los recursos que Bolivia disponía en ese organismo. La necesidad de liquidez para pagar compromisos de deuda externa se hace cada vez más inminente.

Para terminar, si bien la escasez de dólares continúa en la economía, la aproximación de un déficit en la balanza de pagos, que es la imposibilidad de pagar todas las importaciones y la deuda externa, es una presión mucho mayor para obligar a un ajuste en el tipo de cambio, esto desde un punto de vista de la racionalidad económica. Este análisis no incorpora variables de la economía subterránea. Las señales se fueron dando, las alertas de economistas y analistas se fueron mencionando; sin embargo, el gobierno del MAS prefiere mantener el gasto público elevado, mantener el déficit fiscal y sostener su “modelo económico” con publicidad estatal superflua y engañosa.

(*) Economista

https://publico.bo/economia/senales-que-preocupan-en-la-economia-boliviana/