By Marco Antonio Belmonte, Vision 360:

Spending must be reduced

They warn that the high fiscal deficit is a risk and its correction will require tough measures

The former president of the BCB, Juan Antonio Morales, stated that the deficit is corrected with an increase in taxes or a reduction in spending, especially on investment, and this will decrease economic growth.

They warn that to correct the fiscal deficit, investment spending will have to be reduced, as in other countries. Photo ABI

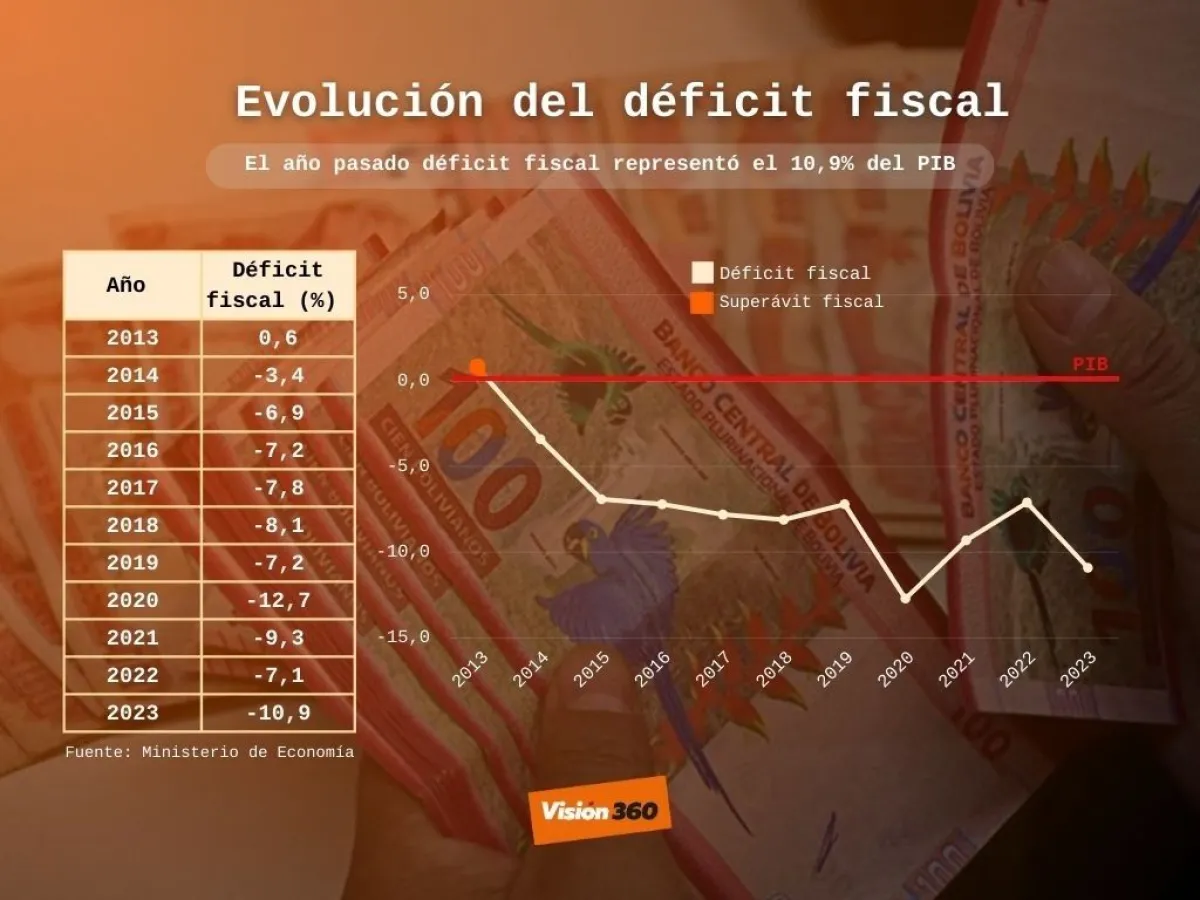

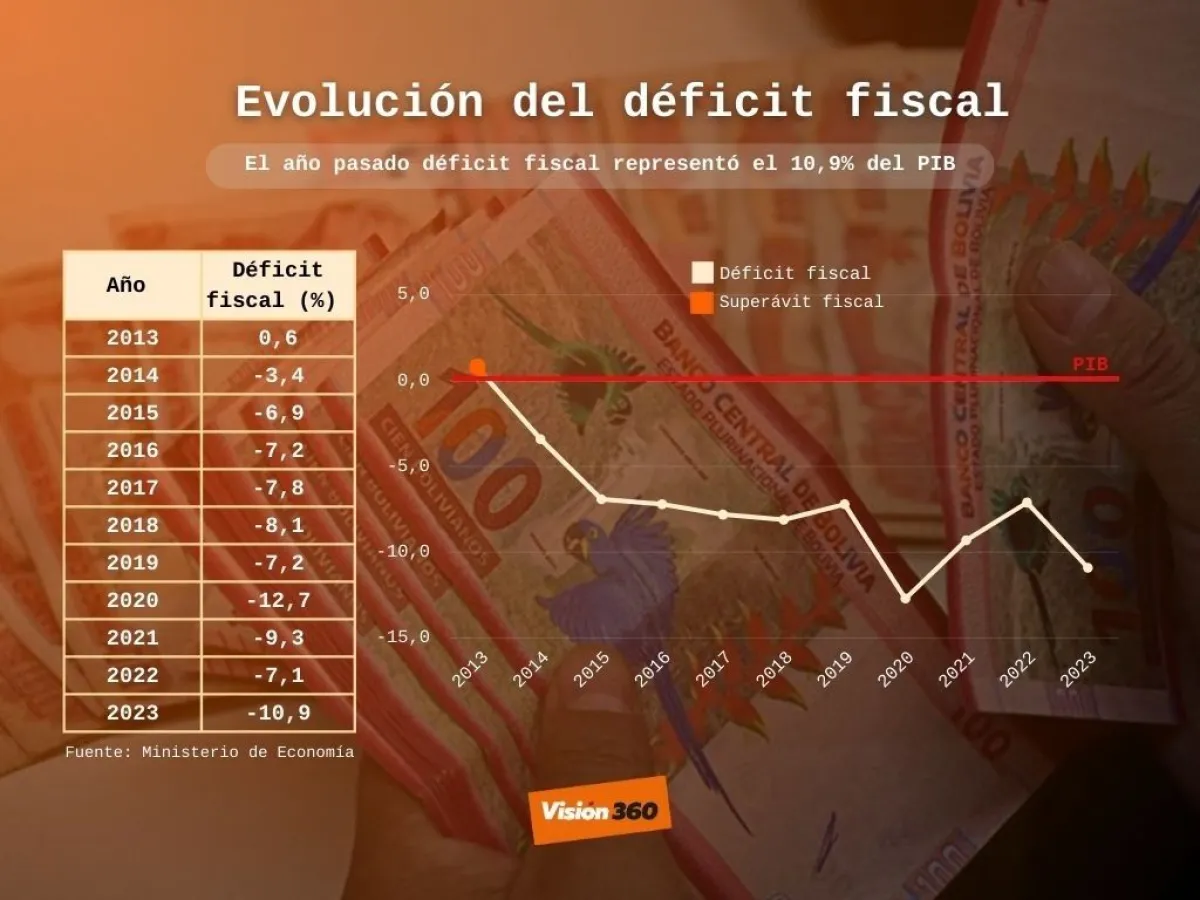

The fiscal deficit in 2023 stood at 10.9% of GDP, and analysts warn that this variable is at a very dangerous limit, and its correction in the future will be “tough” because investment spending will have to be reduced, economic growth will slow, or taxes will have to be raised.

Visión 360 reported Wednesday at noon that in 2023, the global deficit of the Non-Financial Public Sector (fiscal deficit) was 34.1469 billion Bolivianos ($4.9776 billion), according to official figures published by the Ministry of Economy. This amount is equivalent to 10.9% of the Gross Domestic Product (GDP).

According to consolidated public sector operations, last year total revenues amounted to 110 billion Bolivianos, and current revenues exceeded 109 billion (109.96968 billion Bolivianos). However, total expenditures or spending reached over 144 billion Bolivianos (144.234136), with current expenditures exceeding 122 billion Bolivianos (122.578725).

What does having a fiscal deficit of 10.9% mean?

Former President of the Central Bank of Bolivia (BCB), Juan Antonio Morales, explained that a deficit of 11.9% is very dangerous, although not immediately, but over time it can lead to more cracks in the economy.

He added that the rule is that the gap, as a proportion of GDP, should not exceed 3%.

If the deficit is high, it has two immediate implications: it becomes harder to finance, and second, the credit rating deteriorates, increasing the country’s risk.

According to Morales, the problem is that if it’s financed with domestic debt or BCB credit, it involves greater monetary issuance, which can be risky because it generates inflationary pressures.

“We have the experience from the early 80s when we had a high deficit with monetary issuance, and that caused inflation,” he recalled.

According to the former BCB president, the country cannot live forever with such a high fiscal deficit, and in the long term, it will have to be corrected, but this could have severe and serious implications for Bolivian families.

How is a high deficit corrected?

Morales pointed out that this is done in only two ways: Raising taxes or cutting public spending on social services, or a combination of both measures.

“Increasing taxes is politically difficult, and what is likely to happen is that the government will reduce spending, but current spending is inflexible, so it is likely that public investment spending will have to be cut. This will affect economic growth, which will slow down,” he warned.

The president of the College of Economists of Tarija, Fernando Romero, commented that with this level of deficit, Bolivia is already walking a fine line, and the bigger problem is that export revenues are declining. “If an important adjustment is not made and the level of spending is maintained, it will become unsustainable, even carrying the risk of default and currency devaluation like what happened in Argentina,” he warned.

He noted that Bolivia has been running a deficit for 11 years, and the results have exceeded the targets projected by the Ministry of Economy and the BCB, generating other problems in the economy, such as dollar and fuel shortages.

“Despite awareness that expenses are higher, no significant fiscal adjustments have been made, leading to shortages of dollars and fuels, which causes harm to the population. Another problem is inflation because with a higher fiscal deficit, there are fewer possibilities to cover expenses, and the government must resort to internal and external credits,” he emphasized.

Por Marco Antonio Belmonte, Vision 360:

Se debe reducir gastos

Advierten que el elevado déficit fiscal es un riesgo y su corrección demandará medidas duras

El expresidente del BCB, Juan Antonio Morales, opinó que el déficit se corrige con aumento de impuestos o reducción del gasto sobre todo de inversión y eso disminuirá el crecimiento económico.

Advierten que para corregir el déficits fiscal, se tendrá que bajar el gasto de inversión, como en otros países. Foto ABI

El déficit fiscal el año 2023 se situó en 10,9% del PIB y analistas advierten que esa variable se encuentra en un límite muy peligroso y que su corrección en el futuro va a ser “dura” porque se tendrá que reducir el gasto en inversión y el crecimiento económico disminuirá o se deberá aplicar un alza de impuestos.

Visión 360 informó el miércoles a medio día que en 2023 el déficit global del Sector Público No Financiero (déficit fiscal) fue de 34.146,9 millones de bolivianos (4.977,6 millones de dólares), según las cifras oficiales publicadas por el Ministerio de Economía. Este monto es equivalente a un 10,9% del Producto Interno Bruto (PIB).

Según las operaciones consolidadas del sector público, el año pasado se registraron ingresos totales por 110 mil millones de bolivianos e ingresos corrientes de más de 109 mil millones (109.969,680 bolivianos). Pero los egresos o gastos totales sumaron más de 144 mil millones de bolivianos (144.234,136) y los gastos corrientes más de 122 mil millones de bolivianos (122.578,725).

¿Qué significa tener un déficit fiscal de 10,9%?

El expresidente del Banco Central de Bolivia (BCB), Juan Antonio Morales, explicó que un déficit de 11,9% es muy peligroso, aunque no de forma inmediata, pero con tiempo puede dar lugar a más fisuras en la economía.

Añadió que la regla es que la brecha, en proporción del PIB, no debe ser mayor al 3%.

Si el déficit es elevado, tiene dos implicaciones inmediatas: se vuelve más difícil financiarlo, y segundo, se deteriora la calificación de riesgo y aumenta el riesgo país.

Según Morales el problema es que si se financia con deuda interna o crédito del BCB es con una mayor emisión monetaria y eso puede ser un riesgo porque genera presiones inflacionarias.

“Tenemos la experiencia del primer quinquenio de los años 80 cuando se tenía déficit elevado con emisión monetaria y eso generó inflación”, recordó.

Según el expresidente del BCB, el país no puede vivir por siempre con un déficit fiscal tan alto y a largo plazo, se tendrá que corregir, pero eso puede tener implicaciones severas y graves para las familias bolivianas.

¿Cómo se corrige un déficit alto?

Morales señaló que esto se hace solo de dos maneras: Aumentando impuestos o rebajando el gasto público en servicios sociales o combinando ambas medidas.

“El aumento de impuestos políticamente es difícil, y probablemente lo que va pasar es que el Gobierno va reducir gastos, pero el gasto corriente es inflexible es probable que se tenga que reducir el gasto de inversión pública. Esto afectará al crecimiento económico, que será más lento”, advirtió.

El presidente del Colegio de Economistas de Tarija, Fernando Romero, opinó que Bolivia con ese nivel de déficit, el país ya está bordeando la cornisa, y el mayor problema es que los ingresos de exportación están a la baja. “Si es que no se hace un ajuste importante y se mantiene el nivel de gasto, será insostenible, incluso conlleva el riesgo de un default y devaluación de la moneda como ocurrió en Argentina”, alertó.

Señaló que Bolivia lleva 11 años de déficit y los resultados han superado las metas proyectadas por el Ministerio de Economía y el BCB y esto ha generado otros problemas en la economía, escasez de dólares, de combustibles”.

“A pesar de que hay conciencia de que gastos son mayores, no se hicieron ajustes importantes en temas fiscales, eso conlleva a una escasez de dólares, carburantes y ahí la gente sufre el perjuicio. Otro problema es la inflación, porque a mayor déficit fiscal hay menos posibilidades de cubrir gastos y se debe acudir a créditos internos y externos”, subrayó.