Antonio Saravia, El Deber:

My article from two weeks ago, which argued for the need to eliminate social welfare benefits, has sparked several reactions and a couple of interesting articles. Enrique Velazco and Roberto Laserna have joined the debate, expressing their opinions in separate columns that appeared in Brújula Digital.

Let me start by summarizing my original argument. Social welfare benefits cost us over a billion dollars in 2023. This is not a trivial amount for our small economy. A billion dollars represents a third of the fiscal deficit, 60% of our international reserves, and 70% of the subsidy for hydrocarbons (the main factor explaining our fiscal woes). The financing of the Renta Dignidad (by far the most significant benefit, representing 86% of the billion dollars) would have to come from 30% of the IDH and the profits of state-owned enterprises. However, given that 1) the IDH has decreased to a third of its 2014 value and will continue to plummet as we no longer have gas, and 2) state-owned enterprises do not generate profits, the financing of social welfare benefits has been severely compromised.

Faced with this reality, the government approved in 2022 the use of the profits from the Public Pensions Manager to pay for the Renta Dignidad, and in the same year presented a draft law that creates a new tax on the salaries of dependent workers, independent workers, and consultants. According to the Milenio Foundation, the draft establishes “solidarity contributions” of 0.3% on salaries ranging from Bs 2,164 to Bs 10,000, and 0.5% to 3% on higher total incomes. In summary, the reality is that social welfare benefits will be financed in the near future by reaching into people’s pockets.

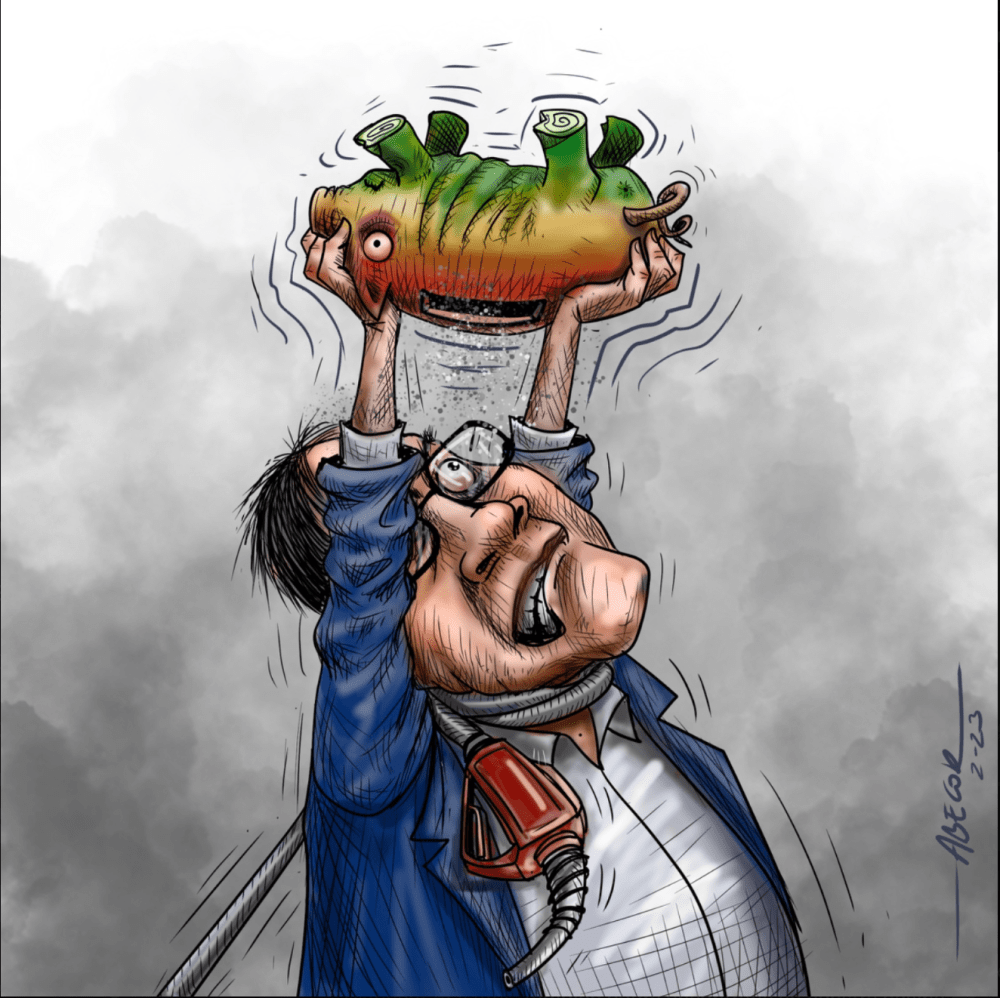

On the benefits side, social welfare benefits do not seem to generate a significant reduction in poverty and certainly do not create the right incentives for recipients. In my article, I cite a study by ECLAC that concludes that social welfare benefits only reduced total poverty in Bolivia by 0.1 percentage point between 2016 and 2017. Moreover, it is crucial to emphasize that welfare benefits give people the fish, not the fishing rod. This creates an economic dependency among recipients (reducing, marginally, incentives to be productive) and also provides a significant opportunity for politicians to buy the favor of different social groups. For all these reasons, I conclude that social welfare benefits should be eliminated.

Enrique Velazco’s article is confusing. Initially, he agrees on the elimination of benefits because they do not have a significant effect on poverty reduction and because they are used for political purposes. So far, complete agreement. Velazco adds that people use the money to buy imported products, and therefore, the benefits do not generate multiplier effects within the country. Although this is not the central point, I must briefly say that he is mistaken in this. That’s the old nationalist criticism of imports. What Velazco does not see is that buying cheap imported products saves money for the national consumer and therefore frees up resources that will later be invested in producing something in which we do have a comparative advantage. The savings afforded by imports and smuggling also generate a multiplier effect. Therefore, this is not a valid reason to oppose benefits.

In a central point where we do not agree, Velazco argues, “if benefits helped reduce structural poverty, even if they affect the deficit, they would justify their existence.” I disagree. Fiscal deficits are tremendously harmful, and nothing should justify them (unless we are talking about emergencies or catastrophes) because their financing comes through debt or printing money. The former mortgages the future of the people because it must be paid back in the future by increasing taxes and paying interest, and the latter generates inflation, which is essentially a tax on the poorest. But the premise is wrong from the start: benefits do not reduce structural poverty! The only thing that does is sustainable employment in the private sector.

The rest of Velazco’s article describes what he sees as a malfunctioning financial system. In his view, the financial system is harmful because it generates many profits, which he sees as a drain on productive resources. We can debate at length about the level of competitiveness in the financial system and what to do to increase it, but what does this have to do with benefits?

Laserna’s article presents a more interesting argument. He doesn’t seem concerned that benefit financing has run out and that they now represent a significant part of the fiscal deficit. His argument is that to eliminate the fiscal deficit, other, more inefficient expenses should be reduced or eliminated. Laserna cites examples such as university budgets, military budgets, bureaucracy, subsidies, and state-owned enterprises. In short, Laserna argues for maintaining benefits at all costs, even if the IDH is zero, by sacrificing other expenses. The argument is that cash transfers allow individuals to decide what to buy, rather than politicians deciding for them.

Economists call these arguments second-best arguments. Indeed, it is always better for people to decide what to do with their money than for politicians to decide for them. The problem is, it’s not their money! In a context where the IDH disappears, the money for benefits comes from taxes, that is, from the pockets of others. Laserna rightly argues that “money is more productive in the hands of the people than in the hands of bureaucracy,” but ignores that the money to pay for those benefits will come precisely from the hands of people who pay taxes. Wouldn’t it be better, then, to let that money stay with those who earned it and let those people voluntarily decide whom to help if they wish to do so?

It is very true, on the other hand, that there are many inefficient expenses that should be eliminated along with benefits. I myself have strongly argued that subsidies for hydrocarbons and all state-owned enterprises should be eliminated, that bureaucracy should be halved and ministries reduced to only 10, and that health and education should be privatized, etc. If all of that were done, of course, there would be less pressure to eliminate social welfare benefits, but that does not mean they should not be eliminated. First, because, once again, their financing comes from taxes, which limits the freedom of choice of the people who pay them, and second, because benefits create dependency and patronage, and reduce incentives to be productive.

The best social policy will always be freedom and unrestricted respect for private property. When these conditions are present, individuals have productive incentives, and private employment is generated. But these conditions are achieved by reducing taxes, reducing fiscal spending, and maintaining sound fiscal accounts. Social welfare benefits, like subsidies for hydrocarbons, bureaucracy, and state-owned enterprises, have already seriously jeopardized the solvency of the state and macroeconomic stability. It is time to stop spending recklessly on all fronts.

Mi artículo de hace dos semanas que planteaba la necesidad de eliminar los bonos sociales ha generado varias reacciones y un par de interesantes artículos. Enrique Velazco y Roberto Laserna se han sumado al debate expresando sus opiniones en sendas columnas que aparecieron en Brújula Digital.

Déjenme partir resumiendo mi argumento original. Los bonos sociales nos costaron más de mil millones de dólares el 2023. Esto no es un monto menor para nuestra pequeña economía. Mil millones de dólares representan la tercera parte del déficit fiscal, el 60% de nuestras reservas internacionales y el 70% del subsidio a los hidrocarburos (el principal factor que explica nuestra tragedia fiscal). El financiamiento de la Renta Dignidad (de lejos el bono más importante ya que representa el 86% de los mil millones de dólares) tendría que provenir del 30% del IDH y de las utilidades de las empresas públicas. Dado, sin embargo, que 1) el IDH se ha reducido a la tercera parte del valor que alcanzó el 2014 y seguirá en picada hasta desaparecer porque ya no tenemos gas, y 2) las empresas públicas no generan utilidades, el financiamiento de los bonos sociales ha quedado seriamente comprometido.

Ante esta realidad el gobierno aprobó el 2022 el uso de las utilidades de la Gestora Pública de Pensiones para pagar la Renta Dignidad y ese mismo año presentó un anteproyecto de ley que crea un nuevo impuesto a los sueldos de trabajadores dependientes, independientes y consultores. De acuerdo con la Fundación Milenio, el anteproyecto establece “aportes solidarios” de 0,3% a los sueldos desde Bs 2.164 hasta Bs.10.000, y de 0,5% y 3% a los ingresos totales más altos. En resumen, la realidad es que los bonos sociales van a ser financiados en un futuro cercano metiéndole la mano al bolsillo a la gente.

Por el lado de los beneficios, los bonos sociales no parecen generar una reducción significativa de la pobreza y ciertamente no generan los incentivos correctos en los que los reciben. En mi artículo cito un estudio de la CEPAL que concluye que los bonos sociales redujeron la pobreza total en Bolivia entre el 2016 y el 2017 en solo un 0,1 punto porcentual. Por otra parte, es importantísimo enfatizar que los bonos le dan a la gente el pescado, no la caña de pescar. Esto genera una dependencia económica entre los que los reciben (reduciendo, en el margen, los incentivos a ser productivos) y produce además una gran oportunidad para que los políticos puedan comprar conciencias entre diferentes grupos sociales. Por todas estas razones concluyo, entonces, que los bonos sociales deben eliminarse.

El artículo de Enrique Velazco es confuso. En principio él está de acuerdo en la eliminación de los bonos porque no tienen un efecto importante en la reducción de la pobreza y porque son utilizados con fines políticos. Hasta ahí completa coincidencia. Velazco añade, además, que la gente usa la plata para comprar productos importados y entonces los bonos no generan efectos multiplicadores dentro del país. Aunque no es el punto central, debo decir brevemente que en esto se equivoca. Esa es la vieja crítica nacionalista a las importaciones. Lo que Velazco no ve es que comprar productos importados baratos le ahorra plata al consumidor nacional y por lo tanto libera recursos que después serán invertidos en la producción de algo en lo que sí tengamos ventaja comparativa. Los ahorros que nos permiten las importaciones y el contrabando también generan un efecto multiplicador. Esta no es, por lo tanto, una razón válida para estar en contra de los bonos.

En algo central en lo que no coincidimos es que, para Velazco, “si los bonos ayudaran a reducir la pobreza estructural, por mucho que afecten al déficit, justificarían su existencia.” Difiero. Los déficits fiscales son tremendamente perversos y nada debiera justificarlos (a menos de que estemos hablando de emergencias o catástrofes) porque su financiamiento se genera a través de deuda o de impresión inorgánica. La primera hipoteca el futuro de la gente porque hay que pagarla en el futuro cobrando más impuestos y pagando intereses, y la segunda genera inflación, que es esencialmente un impuesto para los más pobres. Pero la premisa es errónea de partida: ¡los bonos no reducen la pobreza estructural! Lo único que lo hace es el empleo sostenible en el sector privado.

El resto del artículo de Velazco describe lo que para él es un mal funcionamiento del sistema financiero. En su criterio, el sistema financiero es pernicioso porque genera muchas utilidades lo que, en su criterio, es una extracción de recursos al sistema productivo. Podemos discutir largo y tendido sobre el grado de competitividad en el sistema financiero y que hacer para incrementarlo, pero ¿qué tiene esto que ver con los bonos?

El artículo de Laserna plantea un argumento más interesante. A él no parece preocuparle que el financiamiento de los bonos se haya agotado y que estos representen ahora una parte importante del déficit fiscal. Su argumento es que para eliminar el déficit fiscal se deben reducir o eliminar otros gastos que son más ineficientes. Laserna cita como ejemplos el presupuesto de las universidades o el de las Fuerzas Armadas, la burocracia, los subsidios y las empresas públicas. En suma, Laserna platea mantener los bonos a capa y espada, aun cuando el IDH sea cero, sacrificando otros gastos. El argumento es que una transferencia en cash le permite al individuo decidir que comprar, en lugar de que sea el político el que elija por él.

Los economistas llaman a estos argumentos, argumentos de second best. Efectivamente, es siempre mejor que la gente decida qué hacer con la plata a que lo hagan los políticos. ¡El problema es que no es su plata! En un contexto en que el IDH desaparece, la plata para los bonos sale de impuestos, es decir, de los bolsillos de terceros. Laserna argumenta con certeza que “en manos de la gente el dinero es más productivo que en manos de la burocracia,” pero ignora que la plata para pagar esos bonos saldrá precisamente de las manos de la gente que paga impuestos. ¿No sería mejor, entonces, dejar que esa plata se quede con los que la generaron y que sea esa gente la que decida voluntariamente a quién ayudar si es que desean hacerlo?

Es muy cierto, por otro lado, que hay muchos gastos ineficientes que se deberían eliminar junto a los bonos. Yo mismo he argumentado vehementemente que deberían eliminarse el subsidio a los hidrocarburos y todas las empresas públicas, que deberían reducirse la burocracia a la mitad y los ministerios a solo 10, que deberían privatizarse la salud y la educación, etc. Si se hace todo eso por supuesto que habría menos presión para eliminar los bonos sociales, pero eso no significa que estos no deban eliminarse. Primero porque, otra vez, su financiamiento viene de impuestos y eso le coarta la libertad de elegir a la gente que los paga, y segundo porque los bonos crean dependencia y prebenda, y reducen los incentivos a ser productivos.

La mejor política social será siempre la libertad y el respeto irrestricto a la propiedad privada. Cuando estas condiciones están presentes los individuos tienen incentivos productivos y se genera empleo privado. Pero estas condiciones se logran reduciendo impuestos, reduciendo gasto fiscal y manteniendo cuentas fiscales saneadas. Los bonos sociales, así como el subsidio a los hidrocarburos, la burocracia y las empresas públicas, han puesto ya en grave riesgo la solvencia del Estado y la estabilidad macroeconómica. Es tiempo de dejar de gastar a manos llenas en todos los frentes.

https://eldeber.com.bo/opinion/mas-sobre-la-eliminacion-de-los-bonos-sociales_361617