By Marco Antonio Belmonte, Visión 360:

Volatile Behavior

In some exchange houses the rate is variable, with sales offered at 16.70 bolivianos, 17, and even 17.35, while others have no supply.

The dollar’s rate in the parallel market dropped and remains variable. Photo: ABI

The dollar in exchange houses dropped on Monday morning to as low as 16.70 bolivianos, and in the parallel market it was quoted at 16.41 bolivianos, while USDT was at 16.42 bolivianos. The government stated on Sunday that there is a downward trend, following the ban on Yacimientos Petrolíferos Fiscales Bolivianos (YPFB) from conducting transactions with virtual assets.

In an inquiry carried out today at various currency exchange houses, it was verified that in one place the dollar was priced at 16.70 bolivianos, in another at 17 bolivianos, and in a third at 17.35 bolivianos. In two locations, they said they had no dollars for sale and that the price was still somewhat volatile, though it had slightly dropped to 17 bolivianos.

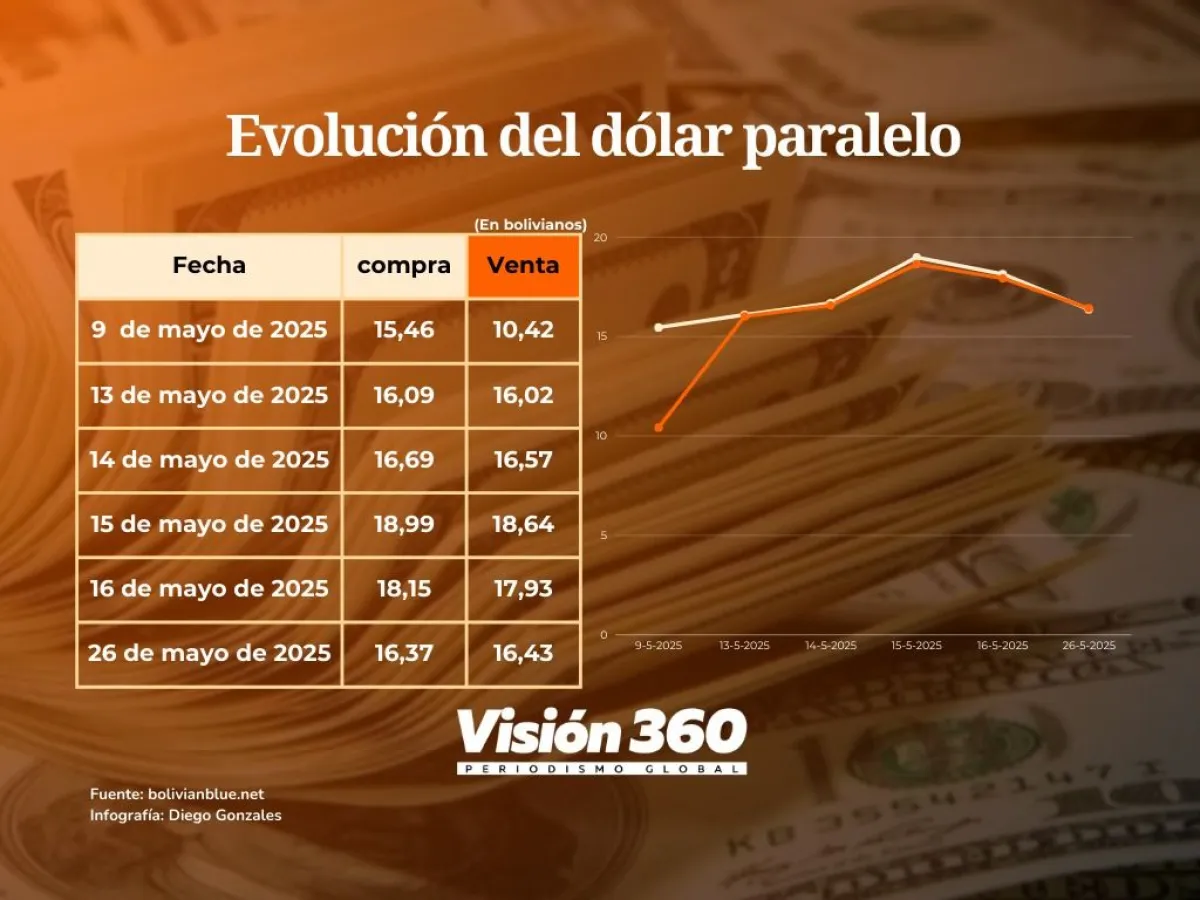

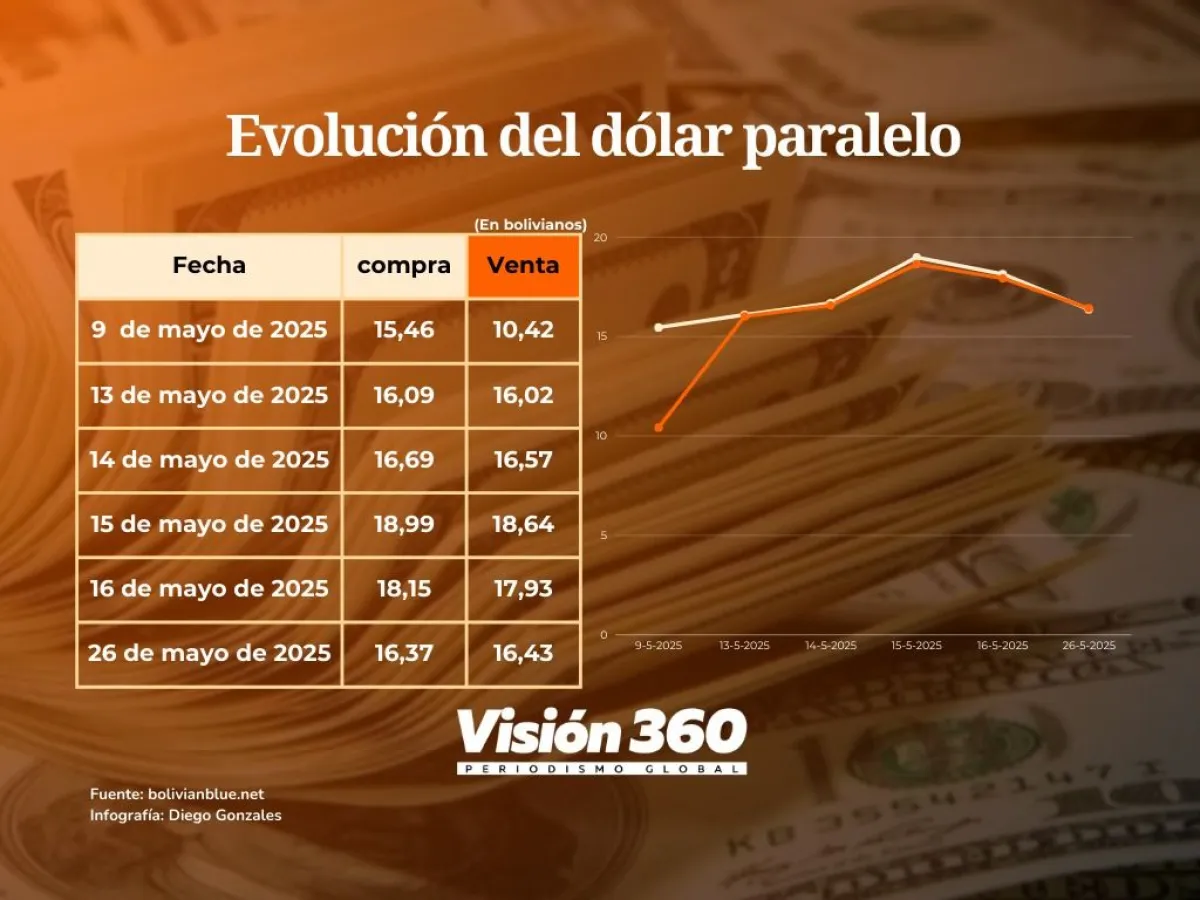

On the website www.dolarbluebolivia.click, it was reported in the morning that the parallel rate was at 16.41 bolivianos. However, at 12:34 p.m., the buying rate was 16.37 bolivianos and the selling rate was 16.43 bolivianos.

On the Binance platform, on Monday morning, the digital dollar USDT was valued at 16.42 bolivianos. On May 24, it had surpassed 17 bolivianos in the early hours, but after President Arce’s announcements, it dropped to 16.63 bolivianos.

Economy Minister Marcelo Montenegro reported on Sunday that the value of USDT (Tether) or cryptocurrency dropped from 17.42 to 16.60 bolivianos after the government’s decision to prohibit YPFB from conducting cryptoasset transactions. At one point on Friday night, the value fell to 13.40 bolivianos, he added.

The use of USDT as an unofficial exchange rate indicator spread in a context of a temporary shortage of foreign currency in the financial system, due to the Plurinational Legislative Assembly’s refusal to approve new loans. “We have more than 1.8 billion dollars being held hostage due to political calculations,” the country’s finance chief denounced.

Amid the lack of physical dollars, digital platforms operating with cryptoassets began to be used as an alternative for transactions and exchange, and their rates spilled over into the parallel market.

The Minister explained that some cryptoasset operators artificially inflated the value of USDT, creating the perception that the real exchange rate was approaching 20 bolivianos per dollar.

Por Marco Antonio Belmonte, Visión 360:

Comportamiento volátil

En algunas casas de cambio la cotización es variable, ya que se ofrece la venta a 16,70 bolivianos, 17 y hasta 17,35, mientras que en otras no hay oferta.

La cotización del dolar en el mercado paralelo bajó y es variable. Foto: ABI

El dólar en las casas de cambio bajó, la mañana de este lunes, hasta 16,70 bolivianos y en el mercado paralelo se cotiza en 16,41 bolivianos, mientras que el USDT está en 16,42 bolivianos. El Gobierno indicó el domingo que hay una tendencia descendente, luego de la prohibición a Yacimientos Petrolíferos Fiscales Bolivianos (YPFB) de realizar operaciones con activos virtuales.

En una consulta realizada hoy en las casas que ofrecen cambios de diferentes monedas, se pudo verificar, en una, que el precio del dólar está en 16,70 bolivianos, en otra en 17 bolivianos y en una tercera, a 17,35 bolivianos. En dos indicaron que no tienen dólares a la venta y que el precio aún esta con algo de volatilidad, aunque bajó levemente a 17 bolivianos.

En el sitio www.dolarbluebolivia.click se reportaba, en la mañana, que la cotización paralela estaba en 16,41 bolivianos. Pero a las 12.34 horas la compra estaba en 16,37 bolivianos y la venta en 16,43 bolivianos.

En la plataforma Binance en horas de la mañana de este lunes el valor del dólar digital USDT se situaba en 16,42 bolivianos. El 24 de mayo superaba los 17 bolivianos a primeras horas, pero luego de los anuncios del presidente Arce bajó a 16,63 bolivianos.

El ministro de Economía, Marcelo Montenegro, informó el domingo que la cotización del USDT (Tether) o criptodivisa, bajó de 17,42 a 16,60 bolivianos, tras la decisión del Gobierno de prohibir a YPFB realizar operaciones con criptoactivos. En un punto de la noche del viernes, el valor descendió hasta 13,40 bolivianos, agregó.

El uso del USDT, como indicador no oficial del tipo de cambio, se extendió en un contexto de escasez coyuntural de divisas en el sistema financiero, debido a la negativa de la Asamblea Legislativa Plurinacional a aprobar nuevos créditos. “Tenemos allí más de 1.800 millones de dólares secuestrados por un cálculo político”, denunció el encargado de las finanzas del país.

Ante la falta de dólares físicos, plataformas digitales que operan con criptoactivos comenzaron a ser empleadas como alternativa para transacciones e intercambio, y su cotización se trasladó al mercado paralelo.

El Ministro explicó que algunos operadores de criptoactivos elevaron artificialmente el valor del USDT, generando la percepción de que el tipo de cambio real se acercaba a 20 bolivianos por dólar.