By Marco Antonio Belmonte, Vision 360:

They accept USDT and bitcoins

Companies are opening up to receiving payments in “cryptos,” as are public entities. To obtain virtual money, it is necessary to create a personal account and purchase these assets through banks or even via QR.

Illustrative image of people’s access to using bitcoins. Illustration: Abecor

Salteñerías, coffee shops, ice cream parlors, stores selling cell phones, and travel agencies now accept cryptocurrency payments. The use of virtual assets is increasing, as is the number of users, who also use them for investment and returns.

Most transactions are carried out by individuals, although corporate interest is also growing.

“La Heredera Salteñería is the first establishment in Bolivia to offer a product that can be paid for with cryptocurrencies. There are already more than 250,000 people in the country using cryptocurrencies; at La Heredera, we provide a very easy and practical system where you can buy salteñas using crypto. You come in, scan, and pay—visit us and step into the future,” states the social media promotion of this well-known establishment in Santa Cruz, located on 6 Este Street in Equipetrol.

“Are you from Bolivia? Did you know that you can now pay for your flights with USDT? It’s a cryptocurrency that offers fast and secure transactions. Book now and fly without limits,” promotes the Moza Viajes agency. Agreda Viajes y Turismo in Cochabamba also offers the option to pay for and book trips with cryptocurrencies.

In Tarija, a food chain also accepts this type of payment. “Papi Pollo is proud to be part of the global economic revolution—Bitcoin is here to change money as we know it,” highlights a video posted on its social media showing a simple transaction with a customer.

In La Paz, Cevichería El Pulpo, located in Achumani, has been promoting itself since last year as the first restaurant in La Paz to accept Bitcoin. “Pay easily and save 15%, plus get extra canchitas with Blink. The flavor of tomorrow, today,” it states on its social media.

Kioskicoffe “Ke Riquito,” an innovative coffee service on Avenida Montes in La Paz that offers a specialty coffee experience, accepts Bitcoin payments.

Rock Café, located at the intersection of Cristóbal de Mendoza Avenue and Libertad in Santa Cruz, also accepts cryptocurrency payments, including USDT. The establishment promotes a unique coffee experience.

At “Acai Mixto,” an ice cream parlor specializing in açaí and other flavors, payments can be made with the cryptocurrency USDT.

These are just a few examples of businesses that have entered the world of cryptocurrencies or virtual assets.

On June 26, 2024, the Central Bank of Bolivia (BCB) announced that it had enabled the use of electronic payment channels and instruments (IEP) for buying and selling virtual assets.

By means of Board Resolution 082, issued on June 25, 2024, the BCB “nullified” Resolution 144 of December 15, 2020, which had prohibited the use of crypto-assets (digital or virtual currencies). This decision enabled the use of electronic payment channels and instruments for the purchase and sale of virtual assets.

Five months later, on November 25, the institution reported that transactions involving the purchase and sale of Virtual Assets (VAs) had increased by 112% through the use of electronic payment instruments.

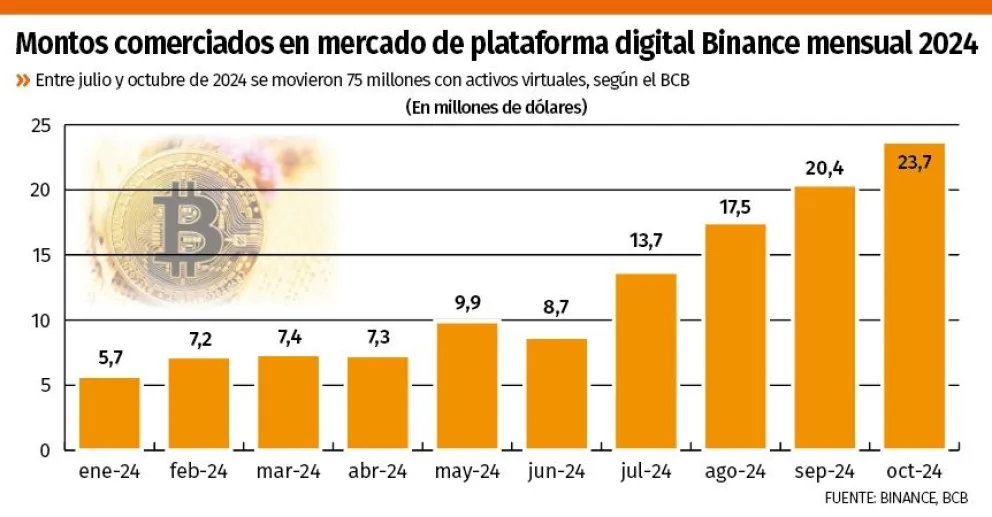

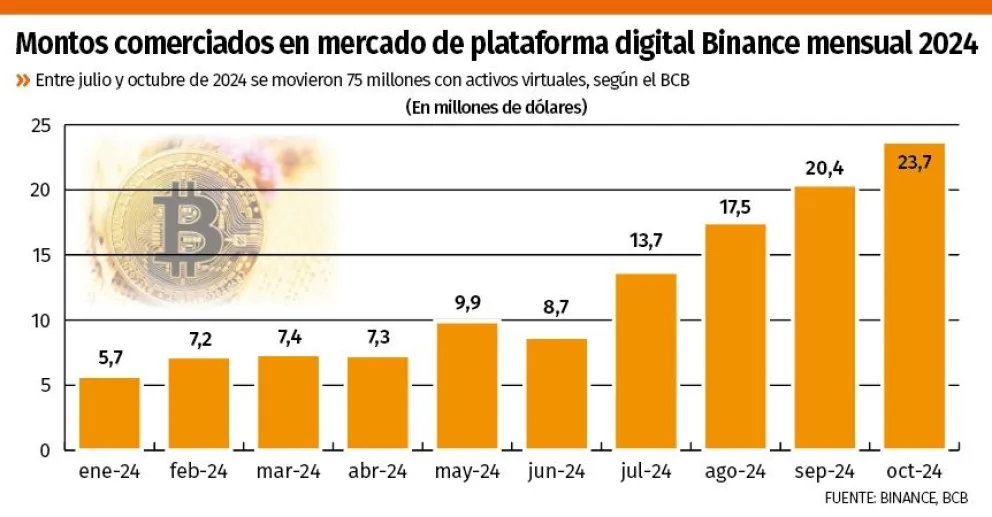

The president of the issuing entity, Edwin Rojas Ulo, stated that more than 252,000 people in the country now hold virtual assets and conduct transactions on various platforms. Between July and October 2024, transactions exceeded 75 million U.S. dollars, compared to 46.4 million dollars in the first half of the year.

Transactions on the Binance platform grew from 13.7 million dollars in July to 23.7 million in October, accumulating over 75 million dollars in four months following the approval of RD 082/2024 on June 25, 2024.

In the national financial system, between July and October 2024, the number of operations with these assets increased from 812 to 1,719, reflecting a rise in transaction value from 0.6 million to 20.1 million bolivianos.

Crypto-assets have become an investment alternative. Financial institutions that engage in virtual asset operations have transacted amounts reaching 20.7 million bolivianos.

According to the BCB, individuals account for the majority of transactions (88%) compared to legal entities, with women conducting 1,029 transactions, representing 62% of the total.

For the BCB, these assets are key players in the 21st century, representing an evolution in value management and shaping the future of finance and the economy. Their influence transcends borders, overcoming the limitations of traditional financial systems.

Payment Mechanisms

Visión 360 spoke with Fabiola, a young professional who receives payments from abroad in USDT for consulting work. She mentioned using Binance, where transactions follow the parallel dollar exchange rate. She also uses Payoneer. On Monday, Binance’s exchange rate was 11.35 bolivianos per dollar.

She noted that Western Union no longer provides U.S. dollars if the transfer was sent in that currency, and the exchange to bolivianos is based on the BCB’s official rate.

Jorge, another young professional engineer, also operates with Binance, which he considers the most widely used platform in Bolivia. He explained that one simply needs to create an account to access a list of available cryptocurrencies, ranging from Bitcoin to stablecoins like USDT, which maintains a value close to one dollar.

To purchase cryptocurrency, he simply enters the market and engages in a virtual peer-to-peer (P2P) transaction with traders, akin to currency exchange dealers, who sell their virtual assets at varying prices.

Cryptocurrency purchases on Binance can be made through several methods, including credit or debit cards, bank transfers, peer-to-peer transactions, or QR payments.

He explained that buying and selling are simple processes. “If someone sends me a remittance or pays me in USDT, the transfer is completed in minutes. If I need cash, I can sell it at the day’s exchange rate. For example, on Monday, the buying price for USDT was 11.30 bolivianos, and the selling price was 11.26 bolivianos per dollar,” he emphasized.

Many still receive remittances through the financial system or Western Union, where the exchange rate is the official one set by the government.

“Depending on the amount, transactions can start from 100 bolivianos with USDT, but with larger movements, such as an equivalent of $1,000, one can make a better profit—around $30, though it varies,” he explained.

Businessman Samuel Doria Medina states that cryptocurrencies are an alternative to counter the shortage of dollars in the country.

Likewise, money can be sent and received from abroad through a digital wallet, converting to bolivianos at the parallel or blue exchange rate at the time. In contrast, if $100 is sent via a bank, only 696 bolivianos are received at the official exchange rate.

He emphasized the importance of caution, recommending that users seek certified operators and proceed prudently with transactions until better regulations are in place, especially for savings.

Public Companies Can Pay with Cryptos

Starting this year, public companies are authorized to conduct operations with virtual assets.

“Companies and public entities engaged in commercial activities are authorized to acquire virtual assets and transfer them to fulfill their contractual obligations incurred in foreign currency,” states Article 7 of the 2025 General State Budget Law.

Supreme Decree 5301, which regulates the 2025 General State Budget, specifies that the Ministry of Economy and Public Finance will establish operational guidelines through a Ministerial Resolution for acquiring and transferring virtual assets to pay contractual obligations in foreign currency by public companies and entities.

It highlights that before engaging in virtual asset transactions, public companies and entities must request foreign currency through the designated mechanisms.

If the request is not fulfilled within ten (10) business days or is denied, they will be authorized—through an amended contract—to pay their contractual obligations with virtual assets. This aims to prevent liabilities arising from non-compliance with suppliers that could result in fines, sanctions, disputes, contract terminations, shortages, or service disruptions.

Additionally, public companies are authorized to purchase virtual assets to exchange them for foreign currency to pay contractual obligations. Virtual assets thus serve as an alternative payment mechanism.

For goods and services contracts signed after the decree takes effect, the regulation states that, as an exceptional and alternative measure, public companies and entities may also include virtual assets as a payment method.

It is clarified that payment with virtual assets does not modify the contract’s established amount.

Exceptionally, the decree allows public companies or entities to make the necessary budget adjustments when payments are made with virtual assets.

Due to the decline in Net International Reserves (RIN) in recent years, the country has faced a reduced supply of foreign currency for importing capital goods, raw materials, and other essential items.

Por Marco Antonio Belmonte, Vision 360:

Aceptan USDT y bitcoins

Empresas se abren a recibir pagos en “criptos”, así como entidades públicas. Para obtener dinero virtual, es necesario crear una cuenta personal y comprar estos recursos a través de bancos o incluso por QR.

Imagen ilustrativa del acceso de la gente al uso de bitcoins. Ilustración: Abecor

Salteñerías, cafeterías, heladerías, tiendas que venden celulares o que ofrecen viajes ya aceptan el pago con criptomonedas. El uso de activos virtuales aumenta, así como el número de usuarios, quienes también los utilizan para invertir y generar rendimientos.

Las operaciones en su mayoría son realizadas por personas naturales, aunque también crece el interés en las empresas.

“La Heredera Salteñería es el primer local en Bolivia en poner a disposición un producto que se puede pagar con criptomonedas. Ya hay más de 250 mil personas en el país usando criptomonedas; nosotros en la salteñería La Heredera ponemos a disposición un esquema muy fácil, muy práctico con el cual puedes comprar salteñas usando criptomonedas. Vienes, escaneas y pagas, visítanos y sube al futuro”, señala la promoción en redes sociales de este conocido local, que está en la ciudad de Santa Cruz, en la calle 6 Este, de Equipetrol.

“Eres de Bolivia. ¿Sabías que? ahora puedes pagar tus vuelos con USDT, es una criptomoneda que ofrece transacciones rápidas y seguras, reserva ya y vuela sin límites”, señala otra promoción de la agencia Moza Viajes. Agreda Viajes y Turismo de Cochabamba también brinda la opción de pagar y reservar viajes con criptomonedas.

En Tarija, una cadena de alimentos también acepta pagos de este tipo. “Papi Pollo orgulloso de ser parte de la revolución económica mundial, bitcoin llegó para cambiar el dinero como lo conocemos”, resalta un video publicado en sus redes sociales en el que se muestra la transacción realizada de manera sencilla con un cliente.

En La Paz, Cevichería el Pulpo, ubicada en Achumani, se promociona desde el año pasado como el primer restaurante en La Paz que acepta Bitcoins. “Paga fácil y ahorra un 15% y llévate canchitas extra con Blink. El sabor del mañana, hoy”, señala en sus redes sociales.

Kioskicoffe “Ke Riquito”, un novedoso servicio de café, ubicado en la avenida Montes de La Paz y que ofrece la experiencia de un café de especialidad, acepta pagos con Bitcoin.

La cafetería Rock, que se encuentra en la avenida Cristóbal de Mendoza, esquina Libertad, en Santa Cruz, también admite el pago con criptomonedas como el USDT. El local promociona degustar un café singular.

En “Acai Mixto” una heladería que promociona el asaí y otros sabores, se puede pagar con la criptomoneda USDT.

Estos son solo algunos ejemplos de negocios que han ingresado a la era de las criptomonedas o activos virtuales.

El 26 de junio de 2024, el Banco Central de Bolivia (BCB) comunicó que habilitó el uso de canales e instrumentos electrónicos de pago (IEP) para operaciones de compra y venta de activos virtuales.

Mediante la Resolución de Directorio 082, del 25 de junio de 2024, el BCB “dejó sin efecto” la Resolución 144, del 15 de diciembre de 2020, que prohibía el uso de criptoactivos (monedas digitales o virtuales). De esa forma, habilitó el uso de canales e instrumentos electrónicos de pago para operaciones de compra y venta de activos virtuales.

Cinco meses después, el 25 de noviembre, la entidad indicó que las operaciones de compra y venta de Activos Virtuales (AV) se incrementaron en 112% a través del uso de instrumentos electrónicos de pago.

El presidente de este ente emisor, Edwin Rojas Ulo, señaló entonces que más de 252 mil personas poseen activos virtuales en el país y realizan transacciones en las diferentes plataformas, y se superaron los 75 millones de dólares estadounidenses entre julio y octubre 2024, en comparación a los 46,4 millones de dólares del primer semestre.

Los montos transados en la plataforma Binance a partir de la aprobación de la RD 082/2024, de 25 de junio de 2024, crecieron de 13,7 millones de dólares en julio, a 23,7 millones en octubre, acumulando en cuatro meses más de 75 millones de dólares.

En el sistema financiero nacional, entre julio y octubre de 2024, la cantidad de operaciones con estos activos escaló de 812 a 1.719, crecimiento que se reflejó en el valor de las transacciones que subió de 0,6 millones a 20,1 millones de bolivianos.

Los criptoactivos se han convertido en una alternativa de inversión. Las entidades financieras que realizan operaciones con activos virtuales han transado montos que llegan a los 20,7 millones de bolivianos.

De acuerdo con el BCB, las personas naturales son las que realizan la mayor cantidad de operaciones (88%) en comparación con las jurídicas, destacándose la participación de las mujeres con un total de 1.029 transacciones, ocupando el 62% de estas.

Para el BCB estos activos son protagonistas del siglo XXI, representan una evolución de cómo se maneja el valor y las transacciones están moldeando el futuro de las finanzas y de la economía. Su influencia atraviesa fronteras, superando las limitaciones de los sistemas financieros tradicionales.

Mecanismos de pago

Visión 360 conversó con Fabiola, una joven profesional que recibe pagos del exterior en USDT por algunos trabajos de consultoría. Contó que usa Binance, en la que las transacciones son al tipo de cambio del dólar paralelo. También emplea Payoneer. El lunes, en Binance el cambio estaba a 11,35 bolivianos por dólar.

Señaló que en Western Union ya no entregan dólares si el envío es en esa moneda y el cambio a bolivianos era sobre la base del tipo de cambio oficial del BCB.

Jorge es otro joven profesional ingeniero que también opera con Binance, que para él es la que más se emplea en Bolivia. Solo se debe crear una cuenta y a partir de aquello se puede visualizar todas las criptomonedas disponibles, desde Bitcoin hasta las stablecoins como USDT que tiene una equivalencia aproximada a un dólar.

Luego, para comprar una criptomoneda, dijo que simplemente acude al mercado y establece una relación de persona a persona en forma virtual P2P con todos los operadores, una especie de librecambistas, que ofrecen a la venta sus activos virtuales con diferentes precios.

La compra de criptomonedas en Binance puede realizarse a través de varios métodos, como tarjetas de crédito o débito, a través de transferencias bancarias o incluso transacciones entre pares o con QR.

Explicó que se compra y se vende. “Si alguien me envía una remesa o me hace un pago con USDT, la transferencia se realiza en cuestión de minutos. Si necesito el dinero, se lo puede vender al tipo de cambio del día. Por ejemplo, el lunes, la compra por USDT estaba en 11,30 bolivianos y la venta en 11,26 bolivianos por dólar”, subrayó.

Muchos aún reciben remesas a través del sistema financiero o Western Union y el tipo de cambio es el oficial fijado por el Gobierno.

“Según la cantidad, se puede mover desde 100 bolivianos con USDT, pero con un mayor movimiento, como un equivalente a 1.000 dólares, se puede obtener una mejor ganancia, alrededor de 30 dólares, es variable”, contó.

El empresario Samuel Doria Medina explica que las criptomonedas son una alternativa para batallar contra la falta de dólares en el país.

Asimismo, se puede enviar y recibir dinero desde y hacia el exterior a través de una billetera digital y se obtienen bolivianos al tipo de cambio paralelo o blue del momento. En cambio, si el envío de 100 dólares es por banco, solo se recibe 696 bolivianos al tipo de cambio oficial.

Es importante, dijo, tener precaución y buscar operadores certificados y actuar con prudencia en las transferencias hasta que exista una mejor regulación, especialmente si se quiere ahorrar.

Empresas públicas pueden pagar con criptos

Desde este año, las empresas públicas están autorizadas a realizar operaciones con activos virtuales.

“Se faculta a las empresas y entidades públicas, que realicen actividades comerciales, a obtener activos virtuales y transferir para cumplir sus obligaciones contractuales contraídas en moneda extranjera”, señala el artículo 7 de la Ley del Presupuesto General del Estado 2025.

En el Decreto Supremo 5301, que reglamenta el PGE 2025, se especifica que el Ministerio de Economía y Finanzas Públicas reglamentará mediante Resolución Ministerial los aspectos operativos para la obtención y transferencia de activos virtuales, para el pago de obligaciones contractuales contraídas en moneda extranjera por empresas y entidades públicas.

Se remarca que las empresas y entidades públicas, con carácter previo a efectuar sus operaciones con activos virtuales, solicitarán divisas mediante los mecanismos habilitados para el efecto.

En caso de no ser atendida la solicitud en el plazo de hasta diez (10) días hábiles o ante una respuesta negativa, estarán habilitadas, mediante la suscripción de un contrato modificatorio, a realizar el pago de sus obligaciones contractuales con activos virtuales, con la finalidad de evitar responsabilidades por incumplimientos con sus proveedores que puedan generar multas, sanciones, controversias, resoluciones de contrato, desabastecimiento y/o falta de servicio.

Además, se autoriza a las empresas públicas la compra de activos virtuales para intercambiar divisas, que servirán para el pago de obligaciones contractuales. Los activos virtuales se constituyen en un mecanismo alternativo de pago.

Para los contratos de bienes y servicios a ser suscritos con posterioridad a la vigencia del decreto supremo, el reglamento señala que excepcional y alternativamente, las empresas y entidades públicas estarán habilitadas para incluir adicionalmente como forma de pago los activos virtuales.

Se aclara que la forma de pago con activos virtuales no implica modificación al monto establecido en el contrato.

De manera excepcional, el decreto autoriza a las empresas o entidades públicas a realizar las modificaciones presupuestarias correspondientes en los casos en que realicen el pago con activos virtuales.

Debido a la caída de las Reservas Internacionales Netas (RIN), en los últimos años, el país enfrenta una reducción en la oferta de divisas para importar bienes de capital, insumos y otros.