By El Diario:

They propose three economic scenarios if the Government opts for stabilization

- International organizations are divided in their projections of the country’s growth; while some lean toward recession, others are optimistic, indicating that it will surpass 1%.

Faced with the dilemma between gradualism and a more drastic adjustment, economist Hugo Siles warns that if the Government decides to seriously apply a stabilization plan with the elimination of subsidies and measures to attract private investment, the country will face a scenario of falling growth and inflation above 30%, with positive results only toward 2030; meanwhile, organizations such as the Milenio Foundation underscore the importance of liquidity and financial stability.

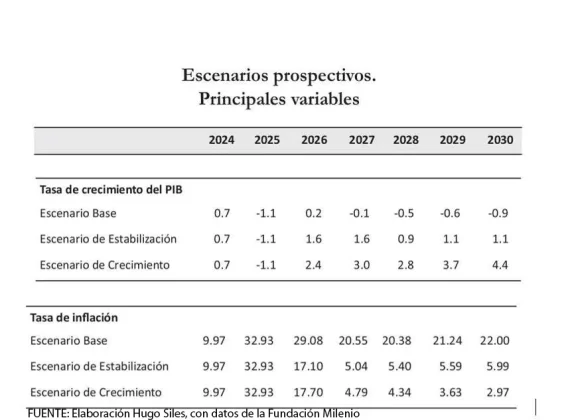

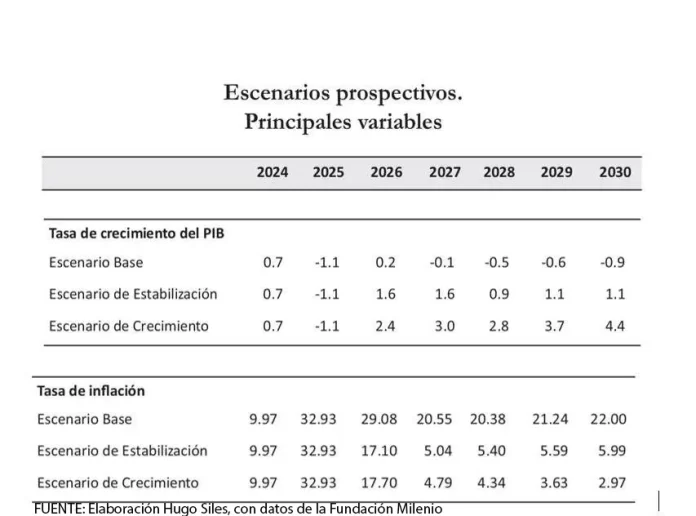

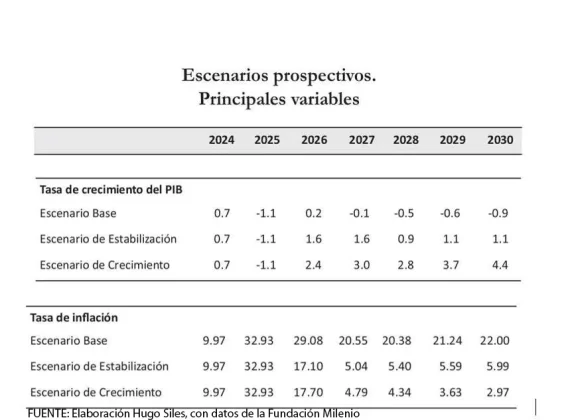

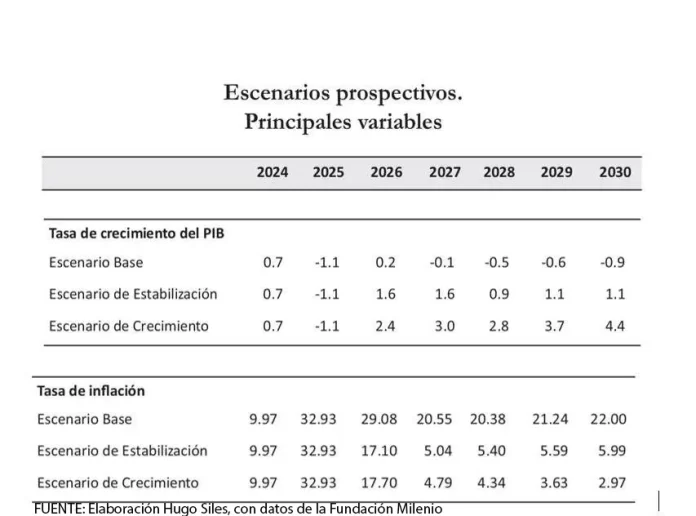

Siles points out that the Milenio Foundation, in its latest economic report presented last Thursday, developed three prospective scenarios: base, stabilization, and growth.

In the first, Milenio maintains that if the current Government does not make changes in the economy, the Gross Domestic Product (GDP) growth rate between 2025 and 2030 will be between -1.1% and -0.9% in 2030. Inflation would be between 32.93% in 2025 and 22% in 2030.

In the second case, if the hydrocarbon subsidy is lifted and fiscal adjustments are made to reduce the public deficit, the GDP growth rate will stand at -1.1% in 2025 and 1.1% in 2030. Inflation in 2025 will be 32.9% and in 2030, 5.99%.

In the third case, if in addition to lifting the hydrocarbon subsidy, fiscal adjustments are carried out and growth policies are promoted (a favorable ecosystem for private investment with regulatory adjustments), growth in 2025 will be -1.1% and in 2030, 4.4%. Inflation in 2025 will reach 32.93% and in 2030, 2.97%.

Liquidity

At the time, economist and professor at the Technical University of Oruro (UTO), Ernesto Bernal, announced that stabilizing the economy will require resources of about 10 billion dollars.

Among the plans of the former candidate of the Alianza Libre, Jorge Quiroga Ramírez, was 12 billion dollars, while now the new State administration, headed by Rodrigo Paz through his Minister of Economy Gabriel Espinoza, announced that they expect to obtain 9 billion dollars for the next three years.

The economic analyst also dared to provide some figures that the national economy will require to stabilize the exchange rate, guarantee the importation of fuels, and meet its international obligations, such as external debt.

Analysis

In the presentation, Milenio emphasized that the food sector is the main inflationary driver, reaching a rate of 36.2% as of September 2025. The subsidy policy could be hiding repressed inflation.

Recently, the elimination of the subsidy for bakers will cause an increase in the price of the marraqueta, between 70% and 80%; a similar situation will occur with fuels, which will also provoke an increase in the prices of basic food basket products.

Growth

In the growth scenario, Milenio projects that the unemployment rate will fall to 2.70% toward 2029, but it requires an aggressive structural reform.

Economists have already pointed out, such as Darío Monasterio, the need to restore institutionalism as well as to provide conditions to attract foreign investment.

It also indicates the decline in hydrocarbon exports by 35% between January and September 2025, being a central factor in the crisis of foreign currency and fiscal revenue.

Spending on diesel and gasoline imports is projected at 2.89 billion dollars for 2025. The subsidy, adjusted to the parallel exchange rate, would hover around 2 billion.

Public debt reached 44.06 billion dollars as of August 2025. The Debt/GDP ratio falls to 78.5% nominally, thanks to the statistical effect of high inflation on GDP.

Meanwhile, the public sector maintains a high fiscal deficit, projected around 10% annually for 2025, repeating previous levels and exacerbating internal pressures. However, economic analysts project a figure close to 11%.

The economic crisis deepened

Milenio states that in the 2025 term, the country is enduring a general deterioration of fiscal, monetary, financial, commercial, and productive indicators. As expected, the economy has entered a recession phase, which deepens macroeconomic imbalances and makes it more difficult to restore economic and social stability.

Analyses by economic experts coincide with those of the Milenio Foundation, which indicates that fuel shortages, accelerating inflation and increased cost of living, as well as the shortage of dollars, the volatility of the exchange rate in the market, lower economic activity, job precariousness, and the reduction of labor and family income are the effects of the crisis the country is experiencing.

“The government of Luis Arce could not stop the advance of the crisis. Its performance, marked by fiscal populism, squandering of resources, rising inflation, chronic shortages, depletion of reserves, and macroeconomic mismanagement, is inherent to the collapse of the Bolivian economy,” indicates the Milenio summary.

Reformulation

Last week, the Minister of Economy and Public Finance, Gabriel Espinoza, announced three decisions to be taken: the payment of debts, the reformulation of the 2026 General State Budget (PGE), and the elimination of four taxes that will be submitted to the consideration of the Legislative Assembly: Wealth Tax (IGF), Financial Transfers Tax (ITF), and the tax on games and business promotions.

On the other hand, the Minister of Hydrocarbons and Energy, Mauricio Medinaceli, stated that in three weeks they will provide a response on the matter of the fuel subsidy, once the analysis of operational costs has been completed.

Por El Diario:

Plantean tres escenarios económicos sí el Gobierno apuesta a la estabilización

- Los organismos internacionales están divididos en las proyecciones de crecimiento del país, mientras unos se inclinan por la recesión, otros son optimistas indicando que va pasar el 1%.

Ante la disyuntiva entre el gradualismo y un ajuste más drástico, el economista Hugo Siles advierte que, si el Gobierno decide aplicar en serio un plan de estabilización con eliminación de subsidios y medidas para atraer inversión privada, el país enfrentará un escenario de caída del crecimiento y una inflación superior al 30%, con resultados positivos recién hacia 2030; mientras tanto, organismos como la Fundación Milenio subrayan la importancia de la liquidez y la estabilidad financiera.

Siles señala que la Fundación Milenio en su último informe de la economía, presentado el pasado jueves, elaboró tres escenarios prospectivos: base, estabilización y crecimiento.

En el primero, Milenio sostiene que, si el actual Gobierno no realiza cambios en la economía, la tasa de crecimiento del Producto Interno Bruto (PIB) entre 2025 y 2030 se ubicará entre -1,1% y -0,9% en 2030. La inflación se ubicaría entre 32,93% en 2025 y 22% en 2030.

En el segundo caso, si se levanta el subsidio a los hidrocarburos y se realiza ajustes fiscales para reducir el déficit público, la tasa de crecimiento del PIB se ubicará en 2025 en -1,1% y en 2030 en 1,1%. La inflación en 2025 será de 32,9% y en 2030 de 5,99%.

En el tercer caso, si además de levantar el subsidio a los hidrocarburos, se realizan ajustes fiscales y se promueven políticas de crecimiento (ecosistema propicio para la inversión privada con ajustes a la normativa), el crecimiento en 2025 será de -1,1% y en 2030 de 4,4%. La inflación en 2025 llegará a 32,93% y en 2030 a 2,97%.

Liquidez

En su momento, el economista y docente de la Universidad Técnica de Oruro (UTO), Ernesto Bernal, anunció que la estabilización de la economía requerirá recursos, de unos 10.000 millones de dólares.

Entre sus planes del excandidato de la Alianza Libre, Jorge Quiroga Ramírez, estaba 12.000 millones de dólares, mientras ahora la nueva administración del Estado, al frente de Rodrigo Paz, mediante su ministro de Economía Gabriel Espinoza, anunció que esperan lograr 9.000 millones de dólares para los próximos tres años.

También el analista económico se animó a dar algunas cifras que requerirá la economía nacional para estabilizar el tipo de cambio, garantizar la importación de combustibles y cumplir con sus obligaciones internacionales, como la deuda externa.

Análisis

En la presentación, Milenio hizo énfasis en que el rubro de alimentos es el principal motor inflacionario, alcanzando una tasa de 36.2% a septiembre de 2025. La política de subsidios podría estar ocultando inflación reprimida.

Recientemente, la eliminación del subsidio a los panificadores va provocar la elevación de la marraqueta, entre 70 a 80% de incremento, similar situación pasará con los combustibles, que también provocará un aumento de precios de los productos de la canasta familiar.

Crecimiento

En el escenario de crecimiento, Milenio proyecta que la tasa de desempleo se reduzca al 2,70% hacia 2029, pero requiere una agresiva reforma estructural.

Ya los economistas han señalado, como Darío Monasterio, la restitución de la institucionalidad, así como brindar las condiciones para atraer inversiones extranjeras.

Además, indica la caída de las exportaciones de hidrocarburos en 35% entre enero a septiembre de 2025, siendo un factor central en la crisis de divisas e ingresos fiscales.

El gasto en importaciones de diésel y gasolina se proyecta 2.890 millones de dólares para 2025. El subsidio, ajustado al tipo de cambio paralelo, rondaría los 2 mil millones.

La deuda pública alcanzó los 44.060 millones de dólares a agosto de 2025. La tasa Deuda/PIB desciende al 78.5% nominal, gracias al efecto estadístico de la alta inflación en el PIB.

Entretanto, el sector público mantiene un elevado déficit fiscal, proyectado en torno al 10% anual para 2025, repitiendo niveles previos y exacerbando las presiones internas. Sin embargo, analistas económicos proyectan una cifra cercana al 11%.

La crisis económica se profundizó

Milenio asegura que en la gestión 2025, el país soporta un deterioro general de los indicadores fiscales, monetarios, financieros, comerciales y productivos. Como era previsible, la economía ha entrado en una fase de recesión, que ahonda los desequilibrios macroeconómicos y hace más difícil restablecer la estabilidad económica y social.

Análisis de expertos en economía coinciden con la de Fundación Milenio, donde señala que la escasez de combustibles, acelerada inflación e incremento del costo de vida, así como la carencia de dólares, la volatilidad del precio de la divisa en el mercado, menor actividad económica, precarización del empleo y la reducción de los ingresos laborales y familiares, son los efectos de la crisis que presenta el país.

“El gobierno de Luis Arce no pudo frenar el avance de la crisis. Su desempeño, signado de populismo fiscal, despilfarro de recursos, inflación ascendente, desabastecimientos crónicos, agotamiento de reservas y descontrol macroeconómico es consustancial con la debacle de la economía boliviana”, indica el resumen de Milenio.

Reformulación

La semana pasada el ministro de Economía y Finanzas Públicas, Gabriel Espinoza, anunció tres determinaciones a tomar: el pago de las deudas, la reformulación del Presupuesto General del Estado (PGE) 2026 y la eliminación de cuatro impuestos, que pondrán a consideración de la Asamblea Legislativa: Impuesto a las Grandes Fortunas (IGF), Impuesto a las Transferencias Financieras (ITF), impuesto a los juego y promociones empresariales.

Por otro lado, el ministro de Hidrocarburos y Energía, Mauricio Medinaceli, afirmó que en tres semanas darán una respuesta al tema de la subvención a los combustibles, una vez que terminen los análisis de los costos de operación.